You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Hancock of the day...

- Thread starter justin

- Start date

DowntownDave

Active Member

- Joined

- May 30, 2006

- Messages

- 315

- Reaction score

- 71

bosdevelopment

Active Member

- Joined

- May 26, 2006

- Messages

- 727

- Reaction score

- 2

Tower talk: Sky?s limit on Hancock price

By Scott Van Voorhis

Boston Herald Business Reporter

Friday, August 11, 2006 - Updated: 02:08 AM EST

Boston?s next big blockbuster business story may be staring you in the face at the center of the Hub?s towering skyline.

The local wise guys and gals of the city?s real estate business are betting the shimmering blue Hancock tower has a good chance of hitting the sales block in the next year or so.

And if it does, it could be a sale price for a skyscraper like Boston has never seen before.

Boston-bred real estate magnate Alan Leventhal bought the Hancock tower and a portfolio of related Copley Square properties for over $900 million three years ago.

And you can bet he won?t settle for anything less than $1 billion, and likely much more, if he opts to pull the trigger.

Not that he would have to worry much about bargain hunters.

A surge of investor enthusiasm in big towers now rivals the tech stock run-up of the late 1990s.

Office towers, not long ago half empty across Boston, are hot again.

Investors, meanwhile, are ready to spend silly money to take that office tower off your hands - that is, if you happen to be so lucky as to be an owner.

How silly?

Try $500 to $700 a square foot.

Enough to push the Hancock tower and a portfolio of nearby buildings past the $1.1 billion mark - promising a $200 million-plus premium for a few years? work.

?It?s a fabulous time to be a seller,? noted Lisa Campoli, executive vice president at Boston-based commercial real estate firm Meredith & Grew.

Could this all be wishful thinking on the part of some deal-hungry executives?

The tea leaves have a different story to tell.

Three years doesn?t sound like a long time to own an office building, but it?s nearly a lifetime for an outfit like Leventhal?s Beacon Capital.

The firm takes a high-flying, Trump-style approach to real estate, buying, pumping up value, and then selling again - all in a few years.

Now some executives believe they hear a time-to-sell alarm clock buzzing in Leventhal?s Financial District office.

The amount of empty space at the Hancock tower has plunged by nearly half in less than a year, while rents for its top floors are soaring.

A key decision point may now be looming.

If Leventhal and Beacon win a high-profile lease renewal battle for prestigious ad giant Hill Holliday, one top Boston real estate executive said he knows what to expect next.

?They will sell it,? the executive predicts. ?It?s time for them to sell.?

After a flurry of nervous calls back and forth, a Beacon spokesman underscored the obvious. No ?for sale? signs out front now, and, he insisted, no discussions about it either.

As for addressing Beacon?s future plans for the Hancock, the company simply doesn?t engage in such discussions.

Too bad, because everyone else in this market already is.

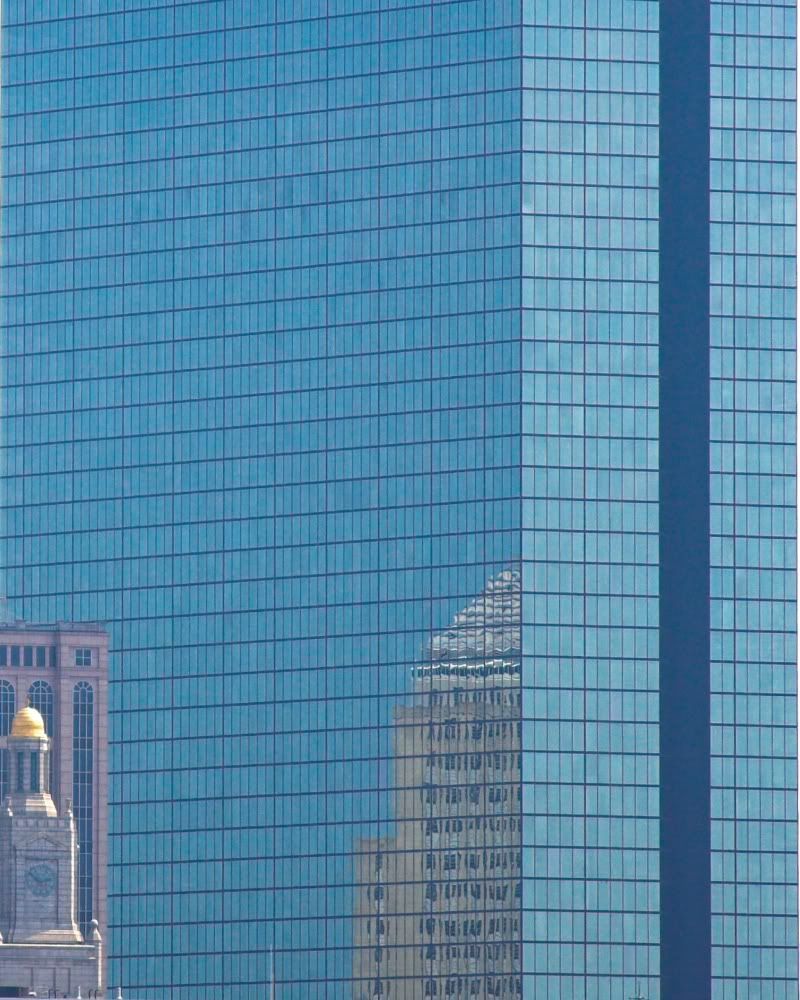

The Hancock tower?s glass and the sun yield an image of Copley Square?s historic Trinity Church yesterday. (Staff photo by Renee Dekona

Link

http://business.bostonherald.com/realestateNews/view.bg?articleid=152348

By Scott Van Voorhis

Boston Herald Business Reporter

Friday, August 11, 2006 - Updated: 02:08 AM EST

Boston?s next big blockbuster business story may be staring you in the face at the center of the Hub?s towering skyline.

The local wise guys and gals of the city?s real estate business are betting the shimmering blue Hancock tower has a good chance of hitting the sales block in the next year or so.

And if it does, it could be a sale price for a skyscraper like Boston has never seen before.

Boston-bred real estate magnate Alan Leventhal bought the Hancock tower and a portfolio of related Copley Square properties for over $900 million three years ago.

And you can bet he won?t settle for anything less than $1 billion, and likely much more, if he opts to pull the trigger.

Not that he would have to worry much about bargain hunters.

A surge of investor enthusiasm in big towers now rivals the tech stock run-up of the late 1990s.

Office towers, not long ago half empty across Boston, are hot again.

Investors, meanwhile, are ready to spend silly money to take that office tower off your hands - that is, if you happen to be so lucky as to be an owner.

How silly?

Try $500 to $700 a square foot.

Enough to push the Hancock tower and a portfolio of nearby buildings past the $1.1 billion mark - promising a $200 million-plus premium for a few years? work.

?It?s a fabulous time to be a seller,? noted Lisa Campoli, executive vice president at Boston-based commercial real estate firm Meredith & Grew.

Could this all be wishful thinking on the part of some deal-hungry executives?

The tea leaves have a different story to tell.

Three years doesn?t sound like a long time to own an office building, but it?s nearly a lifetime for an outfit like Leventhal?s Beacon Capital.

The firm takes a high-flying, Trump-style approach to real estate, buying, pumping up value, and then selling again - all in a few years.

Now some executives believe they hear a time-to-sell alarm clock buzzing in Leventhal?s Financial District office.

The amount of empty space at the Hancock tower has plunged by nearly half in less than a year, while rents for its top floors are soaring.

A key decision point may now be looming.

If Leventhal and Beacon win a high-profile lease renewal battle for prestigious ad giant Hill Holliday, one top Boston real estate executive said he knows what to expect next.

?They will sell it,? the executive predicts. ?It?s time for them to sell.?

After a flurry of nervous calls back and forth, a Beacon spokesman underscored the obvious. No ?for sale? signs out front now, and, he insisted, no discussions about it either.

As for addressing Beacon?s future plans for the Hancock, the company simply doesn?t engage in such discussions.

Too bad, because everyone else in this market already is.

The Hancock tower?s glass and the sun yield an image of Copley Square?s historic Trinity Church yesterday. (Staff photo by Renee Dekona

Link

http://business.bostonherald.com/realestateNews/view.bg?articleid=152348

lexicon506

Active Member

- Joined

- May 25, 2006

- Messages

- 557

- Reaction score

- 278

R

rayray07

Guest

Can somebody tell me how to post pics because I have some very interesting ones!!!

AdamBC

Active Member

- Joined

- Feb 28, 2007

- Messages

- 595

- Reaction score

- 19

rayray

Upload the pictures to a service like ImageShack or PhotoBucket. They will give you a URL where the picture 'is' and copy that. Hit the IMG button in the Post area and paste that URL. Hit the IMG button again. Preview and submit.

Looking forward to your photos!

Upload the pictures to a service like ImageShack or PhotoBucket. They will give you a URL where the picture 'is' and copy that. Hit the IMG button in the Post area and paste that URL. Hit the IMG button again. Preview and submit.

Looking forward to your photos!