You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Boston Life Science Center - Blackfan Circle

- Thread starter kz1000ps

- Start date

kz1000ps said:

Is that dude in the bottom of the picture with a hose washing his Pontiac Bonneville?

.

kz1000ps

Senior Member

- Joined

- May 28, 2006

- Messages

- 8,980

- Reaction score

- 11,798

ZenZen said:Is that dude in the bottom of the picture with a hose washing his Pontiac Bonneville?

Yes sir. And the greenish Ford Expedition to the left had just been done also. I did I find it odd when I was there, but I figure with all the dust being stirred up it kind of makes sense for someone to do that. The guy didn't look like he was a member of the construction company, rather I believe he was just an opportunistic entrepreneur..

awood91

Active Member

- Joined

- Jun 7, 2006

- Messages

- 484

- Reaction score

- 533

Tower isn't even built yet but it's already for sale

By Thomas C. Palmer Jr., Globe Staff | July 12, 2006

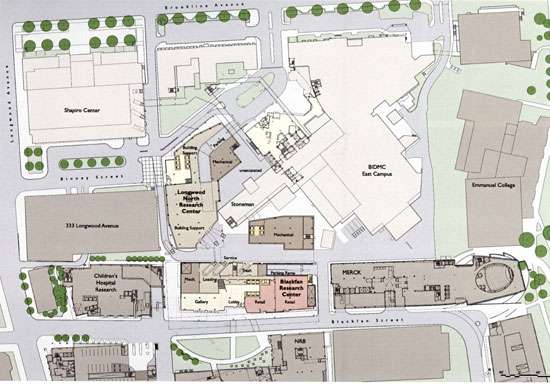

A gleaming 18-story building called the Center for Life Science Boston, underway in the Longwood Medical Area, is still just a hole in the ground. Yet it's already for sale.

So hot is the market for investment properties in commercial real estate -- and so scarce is space for the life sciences industry -- that Lyme Properties LLC, of Cambridge, has elected to sell the project, at 3 Blackfan Circle, 18 months before it opens.

``When we purchased the site we felt it was the best life sciences location in the United States," said David E. Clem, managing director of Lyme Properties, which has also developed properties in the biotech-rich Kendall Square area of Cambridge. ``Our original thought has been validated."

Rob Griffin, president of Cushman & Wakefield of Massachusetts Inc., which is marketing the property, said there is no set asking price, but with so many eager investors available it could go for more than $700 million.

"The hole in the doughnut in the most prestigious life sciences area in the country," he said. ``It will be 100 feet higher than any other building here, right next to Harvard Medical School."

Lyme owns the Center for Life Science Boston with the Scottish Widows Investment Partnership. Lyme declined to disclose its development costs. Depending on sales terms, Lyme could complete the construction itself, or let a new owner finish the project.

Eighty percent of the 703,000-square-foot building has been leased by tenants including two neighbors, Beth Israel Deaconess Medical Center and Children's Hospital Boston. Clem said he expects the building to be fully leased, including the 100,000 square feet that is currently available on the top four floors, by the end of the year. The project includes a 300-car garage being constructed below ground, in an area where available parking, like office space, is hard to find.

Frank Nelson, managing director of Cushman & Wakefield, said that while the vacancy rate for lab and research space in Cambridge is 11.4 percent and heading down, in the Longwood area vacancies are ``nonexistent." He cited a 2004 study that said the area, despite its congestion, will need 2.4 million to 4 million square feet more space in the next decade.

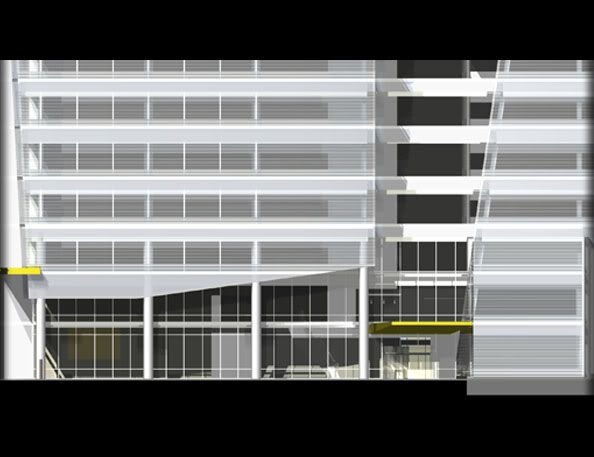

The building, designed by Tsoi/Kobus & Associates Inc. of Cambridge and largely of blue glass, will be asymmetrical, with three sections of varying heights.

A little over a year ago, Lyme, a subsidiary of Lyme Timber Co. of Hanover, N.H., and one of the nation's largest developers of research space, sold eight properties for about $524 million, including the Genzyme Center in Cambridge, to BioMed Realty Trust Inc., of San Diego.

That sale and others, such as the recent deal by the Massachusetts Institute of Technology to sell Technology Square in Cambridge for about $600 million, convinced Lyme it was a good time to put the Longwood project on the block.

Lyme is negotiating the sale of a second phase of development on the site, approved by the city for another 352,000 square feet, to Children's Hospital, Clem said.

Griffin said he expects buyers to line up for the Longwood building, as they did for Technology Square, which got 23 bids.

"It's the number one medical destination in the world," Griffin said. ``It's like if you own residential, you want to be on Central Park in New York."

By Thomas C. Palmer Jr., Globe Staff | July 12, 2006

A gleaming 18-story building called the Center for Life Science Boston, underway in the Longwood Medical Area, is still just a hole in the ground. Yet it's already for sale.

So hot is the market for investment properties in commercial real estate -- and so scarce is space for the life sciences industry -- that Lyme Properties LLC, of Cambridge, has elected to sell the project, at 3 Blackfan Circle, 18 months before it opens.

``When we purchased the site we felt it was the best life sciences location in the United States," said David E. Clem, managing director of Lyme Properties, which has also developed properties in the biotech-rich Kendall Square area of Cambridge. ``Our original thought has been validated."

Rob Griffin, president of Cushman & Wakefield of Massachusetts Inc., which is marketing the property, said there is no set asking price, but with so many eager investors available it could go for more than $700 million.

"The hole in the doughnut in the most prestigious life sciences area in the country," he said. ``It will be 100 feet higher than any other building here, right next to Harvard Medical School."

Lyme owns the Center for Life Science Boston with the Scottish Widows Investment Partnership. Lyme declined to disclose its development costs. Depending on sales terms, Lyme could complete the construction itself, or let a new owner finish the project.

Eighty percent of the 703,000-square-foot building has been leased by tenants including two neighbors, Beth Israel Deaconess Medical Center and Children's Hospital Boston. Clem said he expects the building to be fully leased, including the 100,000 square feet that is currently available on the top four floors, by the end of the year. The project includes a 300-car garage being constructed below ground, in an area where available parking, like office space, is hard to find.

Frank Nelson, managing director of Cushman & Wakefield, said that while the vacancy rate for lab and research space in Cambridge is 11.4 percent and heading down, in the Longwood area vacancies are ``nonexistent." He cited a 2004 study that said the area, despite its congestion, will need 2.4 million to 4 million square feet more space in the next decade.

The building, designed by Tsoi/Kobus & Associates Inc. of Cambridge and largely of blue glass, will be asymmetrical, with three sections of varying heights.

A little over a year ago, Lyme, a subsidiary of Lyme Timber Co. of Hanover, N.H., and one of the nation's largest developers of research space, sold eight properties for about $524 million, including the Genzyme Center in Cambridge, to BioMed Realty Trust Inc., of San Diego.

That sale and others, such as the recent deal by the Massachusetts Institute of Technology to sell Technology Square in Cambridge for about $600 million, convinced Lyme it was a good time to put the Longwood project on the block.

Lyme is negotiating the sale of a second phase of development on the site, approved by the city for another 352,000 square feet, to Children's Hospital, Clem said.

Griffin said he expects buyers to line up for the Longwood building, as they did for Technology Square, which got 23 bids.

"It's the number one medical destination in the world," Griffin said. ``It's like if you own residential, you want to be on Central Park in New York."

lexicon506

Active Member

- Joined

- May 25, 2006

- Messages

- 557

- Reaction score

- 278

Sounds like this is area is in desperate need of a new tower....

quadratdackel

Active Member

- Joined

- May 26, 2006

- Messages

- 145

- Reaction score

- 0

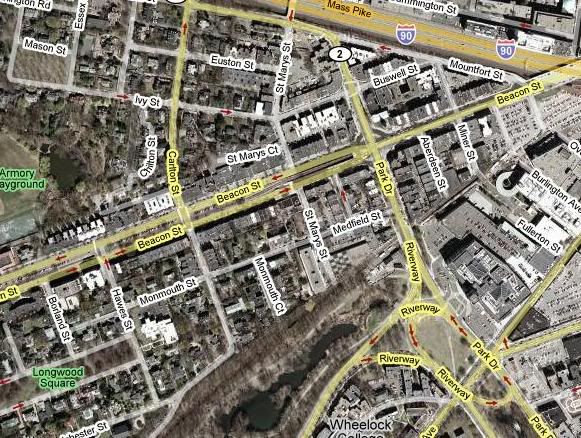

This is why the $1B tunnel under Longwood Ave (and beyond- usually as part of the Urban Ring) probably is worth it: Longwood is a downtown in the making. Major downtowns get built when a very large number of workers benefit financially from being within close proximity to each other. Traditionally, that's only occured within sectors like business and law which have frequent client interactions. The research-oriented sci/tech center generally doesn't need this and opts for cheaper land on the fringes- hence almost all tech companies across the country are in the burbs, and this here urban-minded engineer struggles to find the right workplace. In medical research however, there are clients: hospital patients. Toss in collaborative research efforts, and you have a real downtown area in the making.awood91 said:So hot is the market for investment properties in commercial real estate -- and so scarce is space for the life sciences industry -- that Lyme Properties LLC, of Cambridge, has elected to sell the project, at 3 Blackfan Circle, 18 months before it opens.

Lack of transit is holding Longwood back. From what I've read, access issues are the main thing limiting further development. Traffic congestion there is literally a matter of life and death for patients in ambulances. If it does not become a transit hub and remains a spot halfway down a few spokes, it will not fullfil its potential, which means fewer medical breakthroughs for all of us.

I'm curious how the low-density mansion area between Longwood and BU will play out- if there will be enough pressure to build that section up or if there's too much money keeping it as is.

^ You're absolutely right--Longwood sorely needs a transit line; one that runs north to the future Harvard Life Sciences campus in Allston and the Redline, and south to the BU Medical Center/Boston Medical Center/orange line connection to NEMC. But good luck getting a tunnel built. I don't think we'll ever see so much as an underpass built in Boston ever again.

Ron Newman

Senior Member

- Joined

- May 30, 2006

- Messages

- 8,395

- Reaction score

- 13

That mansion area, west of St. Mary's Street, is all Brookline. I don't think development in Longwood will have any effect on it.

East of St. Mary's is a different story.

It would make sense to build a bus tunnel through Longwood now, that could be upgraded to carry rail tracks later. Getting all of those #8, #47, CT2, CT3, and Harvard-LMA shuttle buses off the streets would help the traffic problem.

East of St. Mary's is a different story.

It would make sense to build a bus tunnel through Longwood now, that could be upgraded to carry rail tracks later. Getting all of those #8, #47, CT2, CT3, and Harvard-LMA shuttle buses off the streets would help the traffic problem.

The mansion is in NIMBY-land Brookline. I believe the town has installed snipers to shoot anyone, especially medical workers, who crosses over this heavily fortified international border.

Luckily for me, I carry a rare Brookline passport, chiseled in stone, of course.

Luckily for me, I carry a rare Brookline passport, chiseled in stone, of course.

blade_bltz

Active Member

- Joined

- Jul 9, 2006

- Messages

- 808

- Reaction score

- 0

The area in Brookline that Ron referred to is one of the prettiest I've seen. If I lived in one of those awesome mansions, I'd be a sniper-hiring NIMBY too.

kz1000ps

Senior Member

- Joined

- May 28, 2006

- Messages

- 8,980

- Reaction score

- 11,798

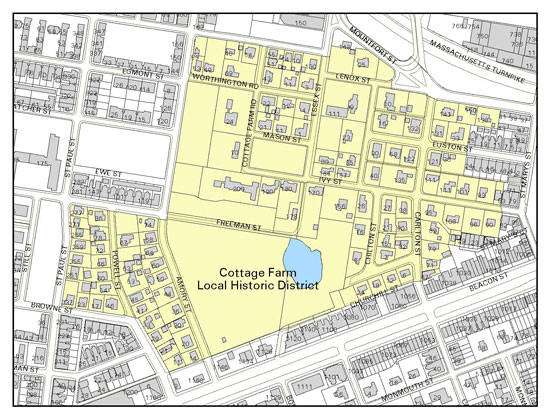

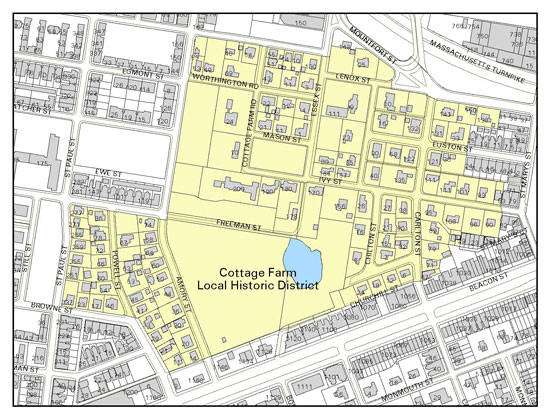

That's all Historic District protected. The area north of Beacon St. is the Cottage Farm Historic District (1978) and south of it, based around the Longwood Mall (map calls it a square, but that's wrong), is the Longwood Historic District (also 1978). These two neighborhoods are absolutely some of the most gorgeous and cohesive places I've ever seen. I count myself very lucky to live so close to them, as I occasionally will go and relax at either park area, and they most certainly deserve to be landmark protected. Let medical development spill over towards Fenway where there's plenty of under-utilized land, not up and over the D line.

Also, I find it rather neat how amidst all the walkups, BU and a highway to the north, and hospitals to the south, there is all of the sudden this patch of low density residences. They clearly stick out in aerial photos, and friends from BU have been amazed at how close their campus is to a treasure trove of mansions and beauty. You literally cross over the highway and there you are.

Here's a map of the Cottage Farm district

Also, I find it rather neat how amidst all the walkups, BU and a highway to the north, and hospitals to the south, there is all of the sudden this patch of low density residences. They clearly stick out in aerial photos, and friends from BU have been amazed at how close their campus is to a treasure trove of mansions and beauty. You literally cross over the highway and there you are.

Here's a map of the Cottage Farm district