Re: Columbus Center

[size=+1]Pike?s projects stall[/size]

Real estate sales no cure for looming deficit ● Deals won?t plug Pike deficit

By Scott Van Voorhis ● July 14, 2008

The Massachusetts Turnpike is facing a financial meltdown, but market conditions prevent it from tapping its most valuable asset - its real estate.

As the authority grapples with a $75 million to $100 million budget gap, the Turnpike is sitting on - or actually under - some of the most valuable stretches of developable property in Boston.

The air rights to build over the Turnpike in Boston are worth, on paper anyway, hundreds of millions of dollars.

But the downturn in the real estate market - coupled with what some say has been the authority?s clumsy handling in the past of its real estate - has for now shuttered this potential goldmine.

?People could say we should be a lot more aggressive with the sale of our real estate,? said Turnpike spokesman Mac Daniel. ?The market is just not there to do that.?

Beyond dispute is the Turnpike?s dire financial situation. Both the authority?s spokesman and the Massachusetts Taxpayers Foundation peg the authority?s budget deficit to be as high as $100 million.

One factor is Big Dig debt. Payments on the project?s bonds are starting to ramp up and the first large principal payments are due, Daniel said. The authority is also dealing with the fallout from questionable financing deals made under former Turnpike chief Matt Amorello, which reportedly could trigger as much as $200 million in increased costs.

Meanwhile, maintenance costs on the new Central Artery tunnel and highway system are also draining away millions in revenue, said Michael Widmer, president of the taxpayers foundation.

That leaves the Turnpike with little choice but to increase tolls to get itself out of its budget jam, some say.

?Certainly time is running short,? Widmer said. ?Certainly by the end of this calendar year they will have to have announced a new toll increase. There is no way you can do this without a new toll increase. The only question is how.?

Market conditions mean the prospect is slim for any help from the Turnpike?s real estate holdings, despite years invested in planning a series of big projects in Boston.

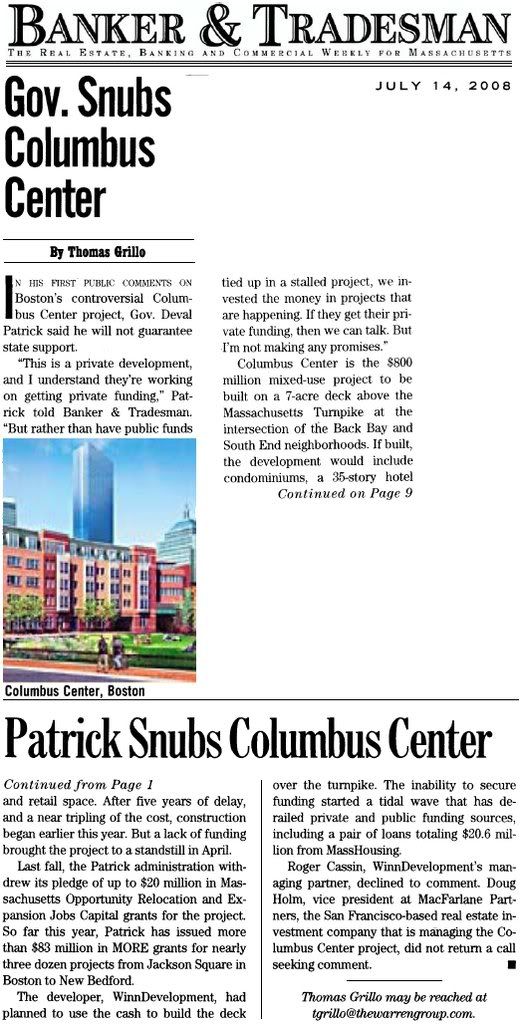

The $800 million Columbus Center plan was supposed to have created a new neighborhood on a deck over the Turnpike between the South End and Back Bay. The development was to have generated millions in lease payments. But after years of community meetings, planning and debate, the project?s developer, Arthur Winn, put the project on hold after losing a key piece of his financing.

Meanwhile, in the Fenway, developer John Rosenthal has also spent years planning a massive air-rights project spanning the Turnpike near Fenway Park [map]. But that project is still under regulatory review, with no immediate prospect of any financial return to the beleaguered Turnpike.

Plans to bring in more than $100 million through the sale of highway-crossed Turnpike land near South Station - dubbed ?South Bay? by Amorello - also turned out to be a big flop.

The slow pace of development along the Turnpike?s Boston corridor stands in stark contrast to rosy assumptions made by authority officials a decade ago when the idea of air-rights development began to take flight.

At that time, the value of the Turnpike?s air-rights holdings was estimated to be in the hundreds of millions.

Those projections helped fuel aggressive plans by the Turnpike to spur construction of mega-projects along prime pieces of the Turnpike?s Boston extension.

But as developers like Columbus Center?s Winn began to craft detailed plans, the economics of the deals began to come under question.

The tens of millions or more it costs to build decks over the Turnpike suddenly loomed large, requiring developers to propose ever-larger towers to make the numbers work. In the case of Columbus Center, that triggered a firestorm of community opposition that led to hundreds of meetings and long delays.

?No one can afford to build the decks,? said downtown tower developer Dean Stratouly. ?You can?t pay for air-rights and then have to create them.?

But the downturn in the economy and the real estate market may have delivered the final blow to some of these big air-rigths projects, at least for of any near-term groundbreaking.

?Clearly at this point in time they will not be seeing any great revenue surge on the real estate issue,? said David Begelfer, head of the local chapter of the National Association of Industrial and Office Properties.

http://www.bostonherald.com/business/real_estate/view.bg?articleid=1106827