You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

MonopolyBag

Active Member

- Joined

- Aug 13, 2010

- Messages

- 449

- Reaction score

- 0

The urban mall? Are you referring to the "Sunbeam?" mall? The one with a dance studio and a model car shop inside? If so, that place is kind of sad. I attracts maybe 2 people a day.

And I have seen and heard other people say a movie theatre more in the city would be more convenient.

And I have seen and heard other people say a movie theatre more in the city would be more convenient.

FrankLloydMike

Active Member

- Joined

- Jun 24, 2010

- Messages

- 514

- Reaction score

- 0

The urban mall? Are you referring to the "Sunbeam?" mall? The one with a dance studio and a model car shop inside? If so, that place is kind of sad. I attracts maybe 2 people a day.

And I have seen and heard other people say a movie theatre more in the city would be more convenient.

I think M. Brown is probably referring to the Hampshire Plaza Mall... or maybe it's not Brady-Sullivan Plaza Mall. Anyway, I went in there to use the post office several years ago and needless to say it was pretty sad. I'm not sure if it was ever very successful, but a few years ago most of the space was converted to student housing for NHIA with the shops facing the street remaining. I'm glad they found a use for it, but long-term that seems like a waste of space, and I'm not sure it's even intended to be long-term. The one-story part of Hampshire Plaza should either be expanded, or probably replaced altogether with some sort of mixed-use block that could include NHIA housing above. I believe the Hippo (and possibly others) has suggested several times in the past that the space be converted to a movie theatre or urban grocery store. There are plenty of good uses, including an actual urban mall or a sort of large, anchor store that could go in as part of a larger development there.

On a side note, my favorite "mall" in terms of ridiculousness was the old, short row of shops along an interior corridor at the Route 101 Plaza (Vista/Harvest Market) in Bedford... I remember there were about four interior stores, and one was a photo studio. Who ever though such things were a good idea?

MonopolyBag

Active Member

- Joined

- Aug 13, 2010

- Messages

- 449

- Reaction score

- 0

Yeah, I think there is some NHIA dorms there now. It is nice inside, but one floor is sad, and there really is no anchor store to attract people. There is the subway I think, which is good, but the edible arrangements, fine store, but attracts no one. A large two floor movie theatre with creative parking there would be great. However the riverside developments phase II and III also provide an optional theatre and personally I think this would be better to get a large company, Regal or AMC down there with an attached parking garage with street side building of a two floor theatre with significant number of showings throughout the day.

The mall needs some more stores in there, should be larger (so there is more of a reason to go there) and should not be 1 floor covering a huge foot print.

The mall needs some more stores in there, should be larger (so there is more of a reason to go there) and should not be 1 floor covering a huge foot print.

FrankLloydMike

Active Member

- Joined

- Jun 24, 2010

- Messages

- 514

- Reaction score

- 0

Another thing that should be pointed out is the that the Hampshire Plaza Mall is one story along Elm, but it's three stories by the time it hits the road behind (which Google calls Plaza Drive, so I'll assume that's accurate). Right now it's all parking beneath the Elm Street-level, but a redevelopment of the site (which should include at least one more story along Elm, but probably two or three) would have the potential to tie the Millyard with Elm Street. Spring Street is one of only about three streets (along with Stark and Pleasant) that runs from Elm to the river. It's also the alternative (and now likely) site of any intercity rail/bus station/transit hub (it's currently on the Downtown Circulator loop). Redeveloping the Hampshire Plaza mall with retail facing Spring Street and Elm Street, and concealing parking somehow, would make a great draw and gateway to the city, while also tying the Millyard and Elm. A larger scale urban mall certainly isn't the only way to do it, but I think it's easy to see a bit of street-facing retail with a couple floors of typical mall stores with parking beneath.

FrankLloydMike

Active Member

- Joined

- Jun 24, 2010

- Messages

- 514

- Reaction score

- 0

Whats going on with the riverside development nowadays?

Not sure where you mean exactly--Rivers Edge, Riverwalk or something else entirely?

M. Brown

Active Member

- Joined

- May 25, 2006

- Messages

- 212

- Reaction score

- 0

Not sure where you mean exactly--Rivers Edge, Riverwalk or something else entirely?

Riverwalk...my bad. There was supposed to be a residential "towers" built but the last time I heard they were on hold. Any news as to if and when they will get built?

MonopolyBag

Active Member

- Joined

- Aug 13, 2010

- Messages

- 449

- Reaction score

- 0

Well riverwalk is getting that additional park with the new Elliot. The Elliot is building a residential building, or at least it was planned. Bu this will come after the retail I think. And then there are the condos past the baseball stadium. Those have been being worked on since last summer.

Any other residential tower I am unaware of.

Any other residential tower I am unaware of.

FrankLloydMike

Active Member

- Joined

- Jun 24, 2010

- Messages

- 514

- Reaction score

- 0

Well riverwalk is getting that additional park with the new Elliot. The Elliot is building a residential building, or at least it was planned. Bu this will come after the retail I think. And then there are the condos past the baseball stadium. Those have been being worked on since last summer.

Any other residential tower I am unaware of.

This sounds right to me... I think I vaguely remember hearing about some towers down there a few years ago, but nothing recently. Personally, it seems like a bit of an odd place for towers down there--it's kind of near downtown, but also fairly isolated because of the railroad tracks. Obviously, the riverside property is a draw. The condos being built down there aren't anything too exciting, but they seem to make sense for the area.

I'd like to see some sort of basic master plan for the area--the Hillier downtown study from 2006 represented putting a new street grid intended for dense residential development in the area where Keyspan, rail yards and the Rivers Edge properties are. With Anagnost owning so much of that property, I think planning something like that could be a good opportunity to get some pretty dense, middle-income housing near downtown and tie into the Riverwalk so it's not so isolated down there.

FrankLloydMike

Active Member

- Joined

- Jun 24, 2010

- Messages

- 514

- Reaction score

- 0

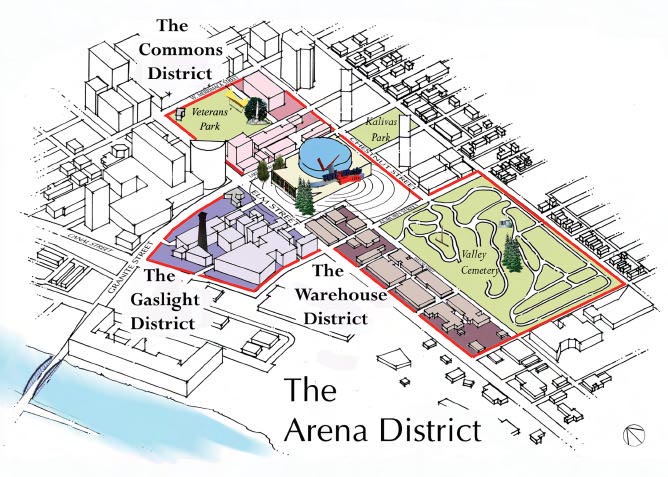

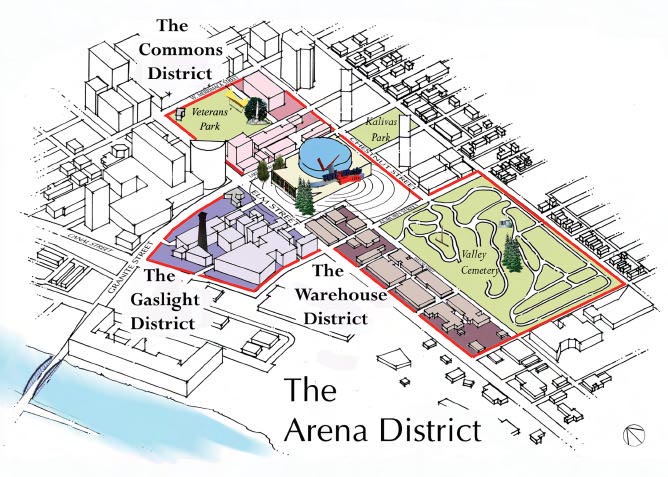

MEDO alerted me to the reposting of the Arena District Urban Design Guidelines, which I hadn't been aware of. I just added a new post to LivableMHT about it:

Growing promise in the Arena District

Growing promise in the Arena District

ManchVegas

New member

- Joined

- Sep 9, 2008

- Messages

- 56

- Reaction score

- 0

Frank, thanks for those renderings and your site is great! Let me know if you ever need pictures of Manchester that I could contribute.

I went up to Manchester this weekend on Saturday night and Sunday. I was really happy to see a lot of people around Elm Street on both days. I used to wonder if the city could support all the new restaurants and bars, but it is very clear that it can. The area has so much potential to become a true destination once some nice stores move in. There was a new furniture store on Elm that I haven't noticed before. A business like that will do more good for the area than a Rent A Center. Looking at the renderings of the arena district, I find that it isn't far fetched planning at all.

I noticed that the Market Basket project has begun because a scrap heap was outside the building next to a large hole in the wall. The court house facelift seems to be coming along just fine as well as renovations to a few older buildings on Elm and side streets.

I went up to Manchester this weekend on Saturday night and Sunday. I was really happy to see a lot of people around Elm Street on both days. I used to wonder if the city could support all the new restaurants and bars, but it is very clear that it can. The area has so much potential to become a true destination once some nice stores move in. There was a new furniture store on Elm that I haven't noticed before. A business like that will do more good for the area than a Rent A Center. Looking at the renderings of the arena district, I find that it isn't far fetched planning at all.

I noticed that the Market Basket project has begun because a scrap heap was outside the building next to a large hole in the wall. The court house facelift seems to be coming along just fine as well as renovations to a few older buildings on Elm and side streets.

Last edited:

FrankLloydMike

Active Member

- Joined

- Jun 24, 2010

- Messages

- 514

- Reaction score

- 0

Hi Manch, I'd love to share any pictures you have. I'm planning to set up a flickr stream or group for the site, as well as using more photos of ongoing and completed developments plus examples of good (and bad) urban planning and livability in the city. If you don't mind contacting me here, you can send some photos or we can figure out how to add them to a LivableMHT flickr.

I was in town this weekend, as well, and saw demolition beginning at the Rockwell site and the progress at the courthouse. I also saw a lot of people walking around downtown--I hope downtown becomes more of a destination, as you say, but I also hope its continued growth will attract more middle-class families and young professionals to Manchester's urban neighborhoods. Right now, downtown is largely a playground and workplace for suburbanites (whether from surrounding towns or outlying neighborhoods). I think the trend toward more socio-economic diversity in Manchester's city center urban neighborhoods is inevitable, but development of areas like the Gaslight and Warehouse that should bring an influx of creative businesses and people to the area will help hasten it.

I was in town this weekend, as well, and saw demolition beginning at the Rockwell site and the progress at the courthouse. I also saw a lot of people walking around downtown--I hope downtown becomes more of a destination, as you say, but I also hope its continued growth will attract more middle-class families and young professionals to Manchester's urban neighborhoods. Right now, downtown is largely a playground and workplace for suburbanites (whether from surrounding towns or outlying neighborhoods). I think the trend toward more socio-economic diversity in Manchester's city center urban neighborhoods is inevitable, but development of areas like the Gaslight and Warehouse that should bring an influx of creative businesses and people to the area will help hasten it.

Last edited:

FrankLloydMike

Active Member

- Joined

- Jun 24, 2010

- Messages

- 514

- Reaction score

- 0

I'm not a huge fan of the pervasiveness of social media, but I do see the value in using them to get the word out about the website, and share to information and generate feedback going forward. So please consider "liking" LivableMHT on Facebook, and tell anyone else you think might be interested. Thanks.

LivableMHT on Facebook

LivableMHT on Facebook

M. Brown

Active Member

- Joined

- May 25, 2006

- Messages

- 212

- Reaction score

- 0

I'm not a huge fan of the pervasiveness of social media, but I do see the value in using them to get the word out about the website, and share to information and generate feedback going forward. So please consider "liking" LivableMHT on Facebook, and tell anyone else you think might be interested. Thanks.

LivableMHT on Facebook

I like.

FrankLloydMike

Active Member

- Joined

- Jun 24, 2010

- Messages

- 514

- Reaction score

- 0

There's an update in the Bedford Bulletin today about the Bedford Mall redevelopment. Not a ton of news, except that the Kohl's is going to be marginally larger than first planned, and in a turn of good news, the proposed fast-food restaurant will now be some sort of "upscale" cafe... sounds like a Starbucks or something, but they didn't say. That's not hugely exciting in itself, but I think even a relatively suburban-style cafe that could potentially have a small patio or something will be more attractive to future, smarter, more walkable development than a drive-thru McDonald's or something.

South River Road will never be downtown Manchester or even a dense, urban neighborhood, but it can be a nice, walkable suburban shopping district, like a smaller version of places in Newton and Brookline. If they narrow the street (or at least add a planted median) and improve sidewalks like Monopoly suggested earlier, continue the street planting, increase the bus frequency and encourage construction closer to the road, the area could slowly become a pleasant, at least pedestrian-friendly mixed use district.

Anyway, here's a promising snippet from the longer article:

South River Road will never be downtown Manchester or even a dense, urban neighborhood, but it can be a nice, walkable suburban shopping district, like a smaller version of places in Newton and Brookline. If they narrow the street (or at least add a planted median) and improve sidewalks like Monopoly suggested earlier, continue the street planting, increase the bus frequency and encourage construction closer to the road, the area could slowly become a pleasant, at least pedestrian-friendly mixed use district.

Anyway, here's a promising snippet from the longer article:

Rick Sawyer, Bedford?s planning director, said the town has high hopes the redevelopment could signal an economic turnaround for commercial properties on South River Road. The Bedford Mall property is owned by Gateway Van Buren, Inc.

?I do believe the project is significant. The timing is great,? Sawyer said in an interview. ?We?re not seeing tremendous amounts of reinvestment. This owner is investing in property.?

This winter, Sawyer helped Bedford create its first-ever Tax Increment Financing district along South River Road, a move that will allow the town to use increased commercial tax revenues to fund road improvements and attract additional businesses to the area.

?We really hope this development will spur that additional interest in redevelopment,? Sawyer said.

MonopolyBag

Active Member

- Joined

- Aug 13, 2010

- Messages

- 449

- Reaction score

- 0

Chicken or egg, ped friendly buildings will not build on a busy rd. But walkable street design is awkward in a heavily dependent on car shopping district.

The only way I see these larger car oriented shopping areas (South River Rd being one which the town wishes it was not) becoming more ped friendly is if a bunch of money was dumped into it to make the street narrow, sidewalks wider, with plantings, and proper crosswalks. From there, buildings will be built around the improved design of the road.

I do not think this is likely to happen just because our nation is in trouble when it comes to money. I did read however in today's Eagle Tribune that NH is basically an awesome state. Haha, the 5 other states in New England are interested in how NH has low taxes and low spending. NH has a fairly high rate of income and a lower poverty rate so less is spent on Welfare, and there was a huge budget cut in NH recently. And more wants to be cut. Good or bad I am glad that NH has low taxes and is not financially screwed like MA.

The only way I see these larger car oriented shopping areas (South River Rd being one which the town wishes it was not) becoming more ped friendly is if a bunch of money was dumped into it to make the street narrow, sidewalks wider, with plantings, and proper crosswalks. From there, buildings will be built around the improved design of the road.

I do not think this is likely to happen just because our nation is in trouble when it comes to money. I did read however in today's Eagle Tribune that NH is basically an awesome state. Haha, the 5 other states in New England are interested in how NH has low taxes and low spending. NH has a fairly high rate of income and a lower poverty rate so less is spent on Welfare, and there was a huge budget cut in NH recently. And more wants to be cut. Good or bad I am glad that NH has low taxes and is not financially screwed like MA.

FrankLloydMike

Active Member

- Joined

- Jun 24, 2010

- Messages

- 514

- Reaction score

- 0

Chicken or egg, ped friendly buildings will not build on a busy rd. But walkable street design is awkward in a heavily dependent on car shopping district.

The only way I see these larger car oriented shopping areas (South River Rd being one which the town wishes it was not) becoming more ped friendly is if a bunch of money was dumped into it to make the street narrow, sidewalks wider, with plantings, and proper crosswalks. From there, buildings will be built around the improved design of the road.

I do not think this is likely to happen just because our nation is in trouble when it comes to money. I did read however in today's Eagle Tribune that NH is basically an awesome state. Haha, the 5 other states in New England are interested in how NH has low taxes and low spending. NH has a fairly high rate of income and a lower poverty rate so less is spent on Welfare, and there was a huge budget cut in NH recently. And more wants to be cut. Good or bad I am glad that NH has low taxes and is not financially screwed like MA.

I mostly agree with the first half of your post--but I do think the Town's efforts to attract mixed-use projects there and the TIF district being able to fund infrastructure improvements is a good step. The TIF district also should enable the area to access some money in otherwise tight times. The road should be narrowed, but even doing a planted median (like Beacon Street through Brookline, but without the T) and adding pedestrian amenities would help. These things aren't great, but the new buildings being built fairly close to the road there are a move in the right direction, and I think have the potential to set the area apart from South Willow Street and other areas. Again, it's never going to be a dense, highly walkable area, but if it's done well, it will be a place where some shoppers will walk between a few stores, and where nearby residents (including among the new apartments and townhouses that the Town hopes to attract) can walk down the street for dinner or coffee. Again, not great, but a good move for the area.

All that said, I completely disagree regarding the tax situation in New Hampshire. New Hampshire has one of the highest median incomes and an absurdly inequitable and piecemeal tax structure. The tax burden falls inordinately on the lower and middle classes, and the reliance on property taxes leads to very poor land use decisions. I like that New Hampshire has no sales tax, but it should have an income tax. Such changes would have a relatively minor impact on most people's disposable incomes and the decision of residents and employers to move to New Hampshire. In fact, the more reliable tax structure and better investment in infrastructure would make the state more attractive in many ways. New Hampshire is often politely called frugal, but it's revenue and spending policies should more accurately be called irresponsibly inadequate. Disavowing increased (and more equitable) revenue results in insufficient and often inefficient funding, where preventative work and civic improvements are put off until they are critical (if even then), and where the sort of investments that attract people and foster greater economic development are not made. As a community, if we want better infrastructure, a reliable public transit system, and more walkable communities, we need to look at our revenue problem. That's not to say that New Hampshire needs to jack up taxes or that it can't work with innovate public/private partnerships, but it does need to assess its priorities and desires, and begin to look at more prudent policy. I wouldn't expect anything on that front until at least after the next elections.

MonopolyBag

Active Member

- Joined

- Aug 13, 2010

- Messages

- 449

- Reaction score

- 0

I somewhat agree. By no means do I think NH has the perfect system. However I also do not think what we have is horrible. I see where you are coming form with the income tax vs. the large property tax that NH has.

I do agree that it could use some changes and most things in government I feel should be looked at with an open mind and drastically changed, however I feel this is not likely to happen any time soon as this countries way of governing seems slow to change and always one step behind and one step too slow.

We address issues once they become problems rather than prior to them becoming problems. Good example would be transit and environmental issues.

I do agree that it could use some changes and most things in government I feel should be looked at with an open mind and drastically changed, however I feel this is not likely to happen any time soon as this countries way of governing seems slow to change and always one step behind and one step too slow.

We address issues once they become problems rather than prior to them becoming problems. Good example would be transit and environmental issues.

FrankLloydMike

Active Member

- Joined

- Jun 24, 2010

- Messages

- 514

- Reaction score

- 0

I somewhat agree. By no means do I think NH has the perfect system. However I also do not think what we have is horrible. I see where you are coming form with the income tax vs. the large property tax that NH has.

I do agree that it could use some changes and most things in government I feel should be looked at with an open mind and drastically changed, however I feel this is not likely to happen any time soon as this countries way of governing seems slow to change and always one step behind and one step too slow.

We address issues once they become problems rather than prior to them becoming problems. Good example would be transit and environmental issues.

Sounds like we're not in such disagreement as I had thought. It's true that no system is perfect, but a lot of people in New Hampshire--and a majority in the current legislature--like to think and say the system in New Hampshire is. Your point that the state (and plenty of other places) addresses issues once they become a problem is proof that the New Hampshire tax system is not perfect.

I don't know enough about tax policy to say what a good system would be, but like anything else, I think diversification is good. A modest (~5%) income tax, possibly with a higher rate for the highest-income earners coupled with reduced property taxes and maybe even a sales tax on especially big-ticket items (say cars, etc), for instance. That's just one example.

New Hampshire, like several other states, does not allow the gas tax to be used for non-highway expenses. This is an idiotic, seventy-year, constitutional policy that will be difficult to change, but the tax (already the lowest in New England) could be raised to encourage carpooling and public transit. I believe the tax can be used to fund buses, but I'm not positive.

Another big problem in New Hampshire is the variability of taxes from town to town. Because so much of a town's (and the state's) revenue comes from property taxes, you have neighboring communities competing to attract development, and basically selling out to the highest bidder. This leads to redundant sprawl, green space development, and more big box stores. I'd love to see some sort of metropolitan organization (say SNHPC) be given more control over regional planning and taxes. The system would be complicated and there would certainly be resistance in favor of local control, but working out a system of shared planning, revenues and expenses would allow for smarter growth without towns having to give up revenues. I have no idea how feasible such a system would be.

There's an interesting, allegorical opinion piece in yesterday's Concord Monitor about New Hampshire's dysfunctional obsession with cutting already absurdly low taxes.

You might also be interested to read some stuff from the group, Granite State Fair Tax Coalition, which favors a more equitable and reliable tax structure.