KentXie

Senior Member

- Joined

- May 25, 2006

- Messages

- 4,195

- Reaction score

- 766

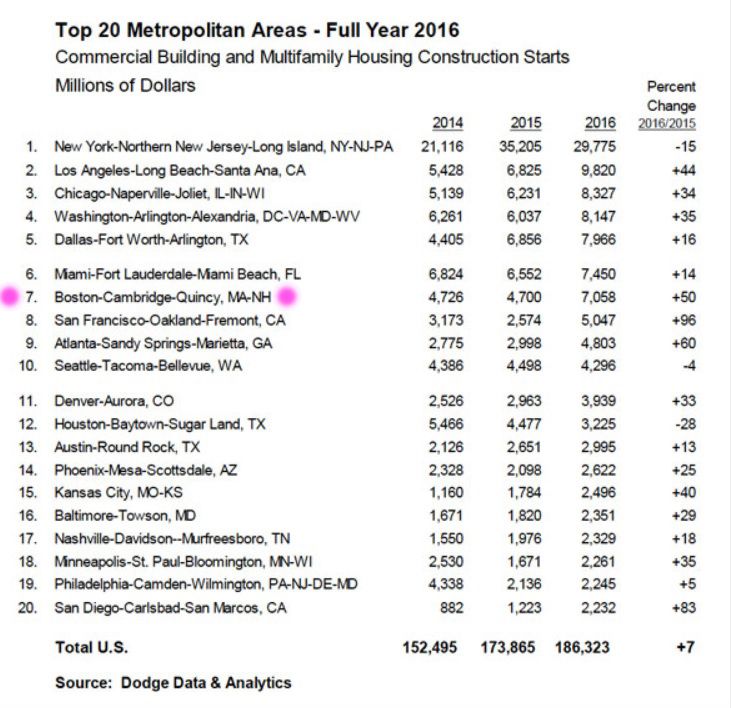

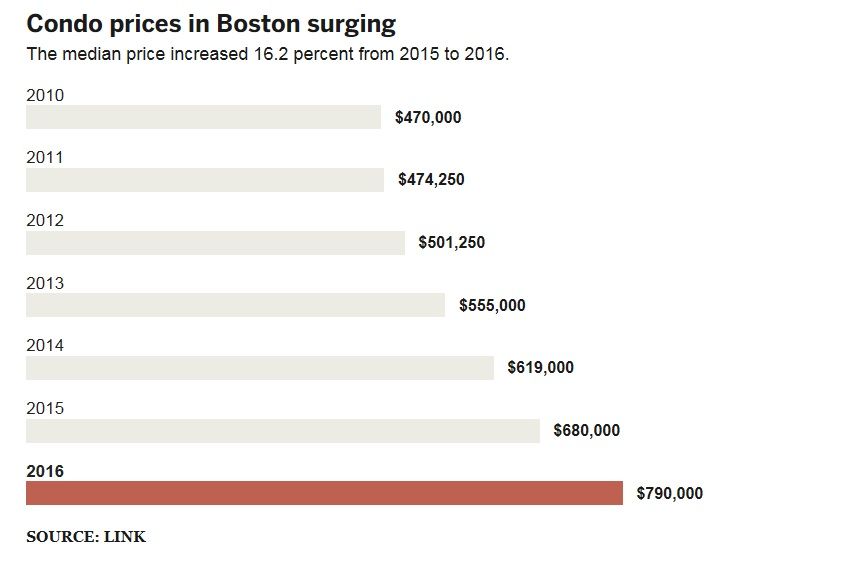

Boston and the surrounding areas are GONE.

You need to rich to move into the area.

Medford, Somerville, Charlestown, Cambridge a starter a house with a couple of kids would probably run you 850-1,000,000

My question is you see the high cost of living along with the major traffic problem.

Then why would this Liberal state give such generous tax breaks and incentives to the corporations to claim we need job creation?

Liberty Mutual

Fan Pier

GE

But then they give a private developer a problem knocking a garage down to add more housing supply on a rapid transit line.

The logic in this state does not make sense.

The city of Boston needs add supply in housing very desperately to bring the costs down.

The way I see it is Massachusetts there will be very Rich people living in the inner city of Boston and very upper class of society. There will be no more balance anymore.

All the poor people will get pushed out to Worcester or New Bedford areas.

Boston is a very Liberal city but the only people that can afford it millionaires. I thought liberals were about a society of balance.

I did say Trump was a better candidate than Hilary: He might be draining the swamp in Washington only to put his own swamp in place.

How hypocritical was the democratic party for the voting fraud that took place for Hilary Clinton elected over Bernie Sanders in the primaries only to lose to Trump. I saw that coming a mile away.

If I was a Democrat I would have requested an Investigation on the relationship of debbie wasserman Schultz who was the DNC Chairman and Donna Brazile who pretty much fixed the race again Bernie Sanders.

There should be people arrested on this.

No justice and this why Liberals suck. Oh sorry

Stop blaming the rich you f*cking liberal.