- Joined

- Dec 10, 2011

- Messages

- 5,599

- Reaction score

- 2,717

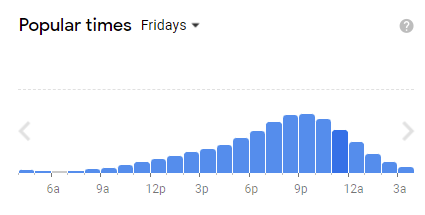

We actually had from Google Maps the "popular times" graphs for the Casino, and, (from memory), since it does not have a 9am start nor a 6pm anything it was very "contra-rush"

- Arrivals weren't significant until after 10am and were smooth all day...ergo not contributing to morning rush (probably also more a "busload of retirees" kind of vehicular traffic at 10am)d

- Seemed to have a small lunch peak, on Friday (Mohegan Sun, below, doesn't have this, maybe because it is too far for "just lunch")

- Built slowly from 10am to 6pm, then a step up at 7pm to 10pm then tapered off...ergo not contributing much to the evening rush

- Weekend traffic was also a long slow "breathe in" and a consistent "breathe out"

In sum, while it generates many trips, there's no reason to believe it creates much congestion.

(This seems to be missing now, but you can still see a similar pattern for Mohegan Sun, which still has an "all venue business" number)

Mohegan Sun's Friday Graph:

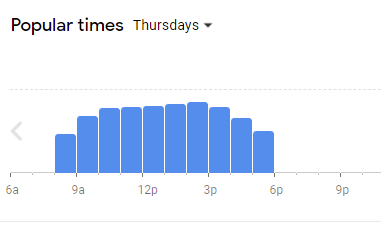

Compare this to, say 200 Berkeley St (office tower), which clearly pulls most people in for a sharp AM inbound rush and a less-sharp PM departure rush...which is to say, your classic Rush Hour pattern:

- Arrivals weren't significant until after 10am and were smooth all day...ergo not contributing to morning rush (probably also more a "busload of retirees" kind of vehicular traffic at 10am)d

- Seemed to have a small lunch peak, on Friday (Mohegan Sun, below, doesn't have this, maybe because it is too far for "just lunch")

- Built slowly from 10am to 6pm, then a step up at 7pm to 10pm then tapered off...ergo not contributing much to the evening rush

- Weekend traffic was also a long slow "breathe in" and a consistent "breathe out"

In sum, while it generates many trips, there's no reason to believe it creates much congestion.

(This seems to be missing now, but you can still see a similar pattern for Mohegan Sun, which still has an "all venue business" number)

Mohegan Sun's Friday Graph:

Compare this to, say 200 Berkeley St (office tower), which clearly pulls most people in for a sharp AM inbound rush and a less-sharp PM departure rush...which is to say, your classic Rush Hour pattern:

Last edited:

IMG_2098

IMG_2098