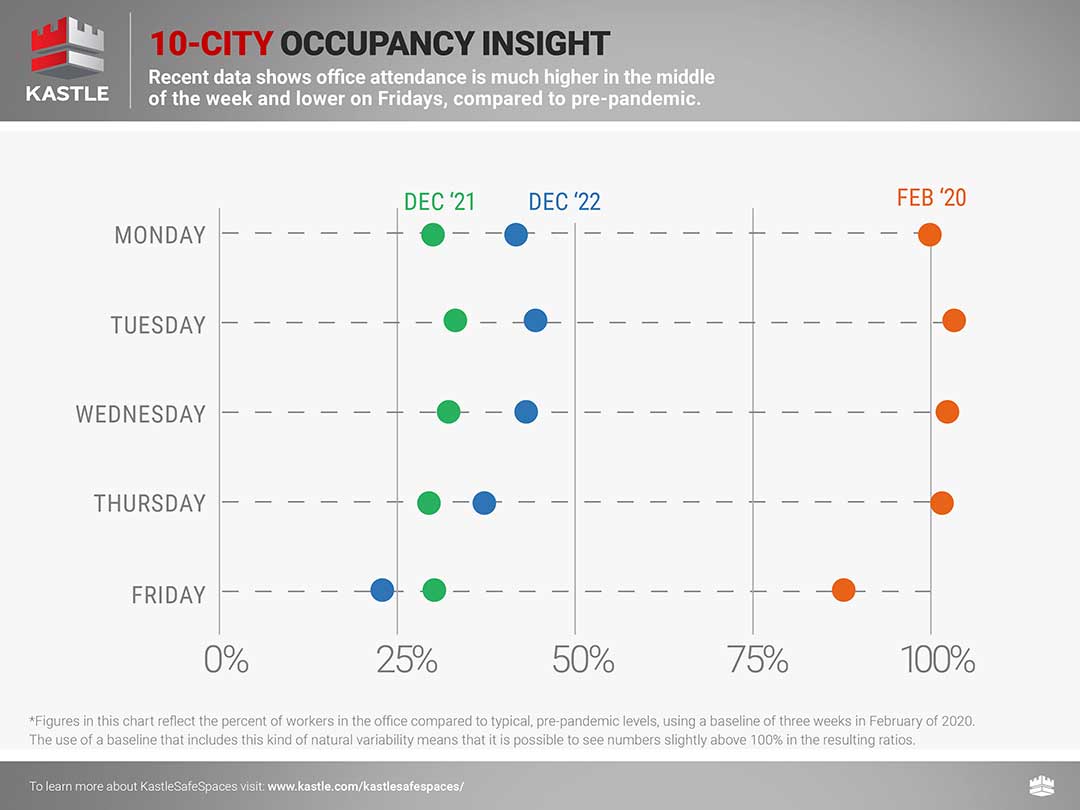

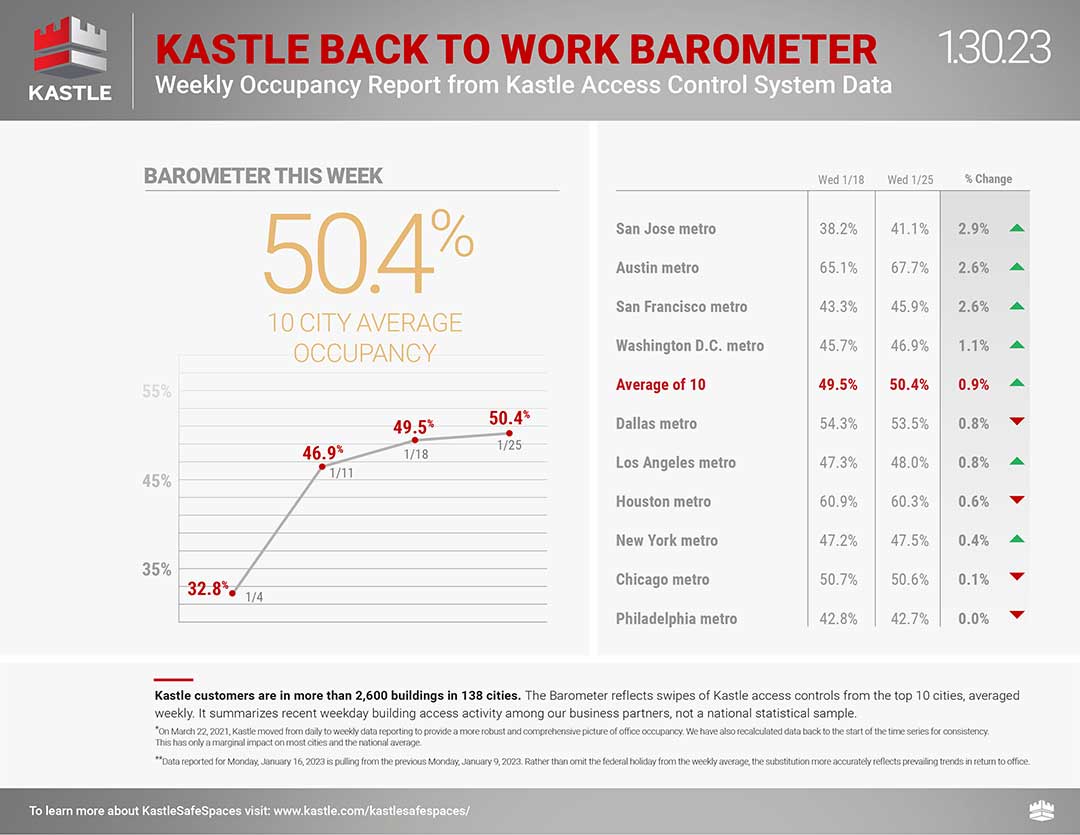

As of the third week of January, the percentage of workers showing up at their downtown offices reached a weekly average of 45 percent, with that number rising to 54 percent on Wednesdays, according to data collected by Kastle Systems, which measures traffic through access cards (the weakest days are those adjacent to weekends).

...........

Even before the pandemic, downtown Washington had an oversupply of offices that was aggravated by the emergence of telework and competition from emerging neighborhoods such as

the Wharf. That dynamic has only accelerated since 2020. According to a 2022 survey by the D.C. Policy Center, 137 of the city’s 733 large office buildings — most of them downtown — had vacancy rates of more than 25 percent. An analyses by the CBRE real estate firm found that vacancy rates by the end of 2022 had reached 20 percent in the city’s most modern offices and nearly 25 percent in older buildings.

....

Gray also said she felt buoyed by Bowser’s

plan to create thousands of apartments downtown, an aspiration that includes a long-term goal of attracting 100,000 new residents to the city’s core. The mayor has said she would use tax subsidies to encourage the conversions of offices to apartments and may seek to relax

height limits in certain spots as an added inducement, a change that would require congressional approval. A total of three office-to-apartment conversions have been completed downtown, while 12 more are planned or under construction, according to the downtown BID.

Yet, developers say that the conversions are not a panacea for downtown’s future. Their hurdles at the moment include rising interest rates and construction costs. They also question whether a sufficient number of offices exist that are suitable for conversion, saying that many are midblock and have partial views.

“The concept is a good one, but it’s not practical in most instances,” said Herb Miller, a longtime D.C. developer. “How do you convert an office building into apartments when 50 percent of the building doesn’t have windows?”