stellarfun

Senior Member

- Joined

- Dec 28, 2006

- Messages

- 5,711

- Reaction score

- 1,544

Re: Whiskey Priest/Atlantic Beer Garden Redevelopment | 150 Seaport Blvd | Seaport

Thanks for the link.

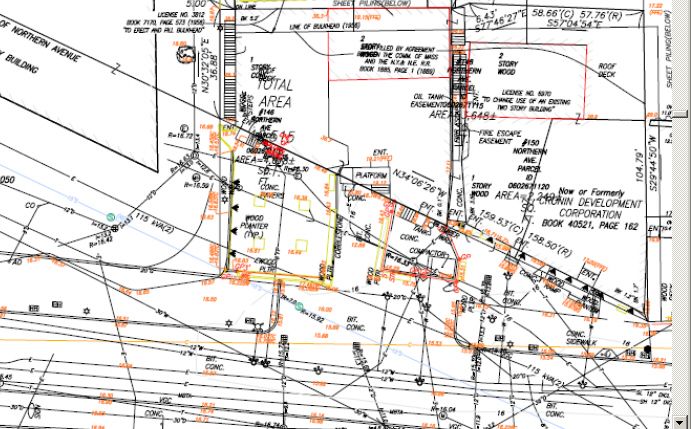

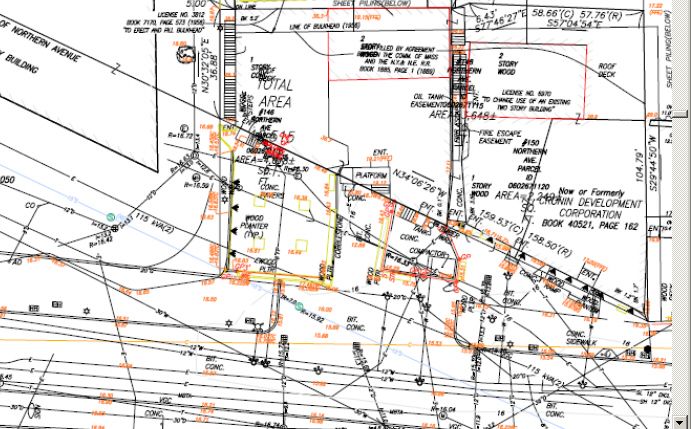

From the floorplans, 150 Seaport leaves the 115KV line in place, and the area above the underground line as open space. The line cuts across the far southwest corner of the Triangle parcel, at most perhaps 3 feet inboard of the sidewalk where the Triangle parcel and Tishman Speyer's sidewalk abut. Cronin will not be incurring any cost for moving the line.

^^^ The 115 KV line is just above the blue line with the several blue dots.

I could certainly build on the Triangle parcel without touching or disturbing the 115 KV line.

Several nearby assessments for what are unbuildable, unusable, small lots.

Both on C St. no number, north of the BCEC, east of the vent building, the parcels are either over a ramp, or include part of a roadway.

2790 sq ft, $446,000 assessed value; $160 a sq ft

1875 sq ft, $319,000 assessed value; $170 a sq ft.

From the BRA:

https://twitter.com/BostonRedevelop/status/765908245374496768

The assessed values for land quoted above are for permitted parcels with millions of square feet approved. The sliver parcel can never be built on (unless you spend $20M to move the 115KV line).

Thanks for the link.

From the floorplans, 150 Seaport leaves the 115KV line in place, and the area above the underground line as open space. The line cuts across the far southwest corner of the Triangle parcel, at most perhaps 3 feet inboard of the sidewalk where the Triangle parcel and Tishman Speyer's sidewalk abut. Cronin will not be incurring any cost for moving the line.

^^^ The 115 KV line is just above the blue line with the several blue dots.

I could certainly build on the Triangle parcel without touching or disturbing the 115 KV line.

Several nearby assessments for what are unbuildable, unusable, small lots.

Both on C St. no number, north of the BCEC, east of the vent building, the parcels are either over a ramp, or include part of a roadway.

2790 sq ft, $446,000 assessed value; $160 a sq ft

1875 sq ft, $319,000 assessed value; $170 a sq ft.