DZH22 fed me a softball, so I'll pick up the mic again. Why is Boston Properties building higher in San Francisco? Let me quote from CBRE's market report on Boston from last year:

"Although average asking rents in 2015 are below other peak cycles in 2000 and 2008, the last nine consecutive quarters have experienced rent increases ... even at an average asking rate of $50 psf, the cost of doing business in Boston is considerably less than in other markets and underpriced as a world class city with room to grow."

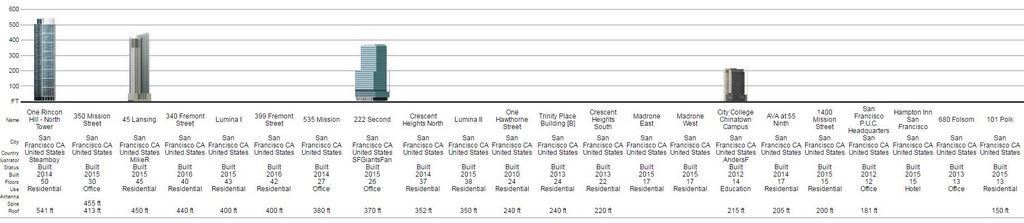

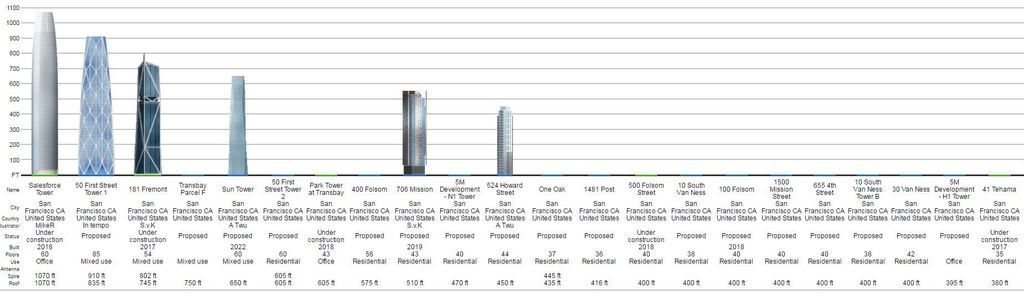

I'll spare you the parallel quote from their Bay Area report, but to summarize: San Francisco presents arguably an even more restrictive building/regulatory environment and a more constrained geographical footprint than Boston and by most measures overall commercial rents there are about 20% higher, approaching Manhattan numbers in some areas. There's also a huge pent-up demand as more and more tech companies are shifting their center of gravity north from the Peninsula, which provides a wealth of tenants to sign to mitigate risk. And if you've ever had to price a condo in the Bay Area you know it's one of the few places in the USA that makes Boston look a bargain. You could have posed a slightly tougher counterexample (Seattle?) but we aren't San Francisco (or Manhattan, London, Shanghai, Hong Kong, etcetera). If Boston Properties is using the exact same spreadsheet, it will burp out a much higher build there than here.

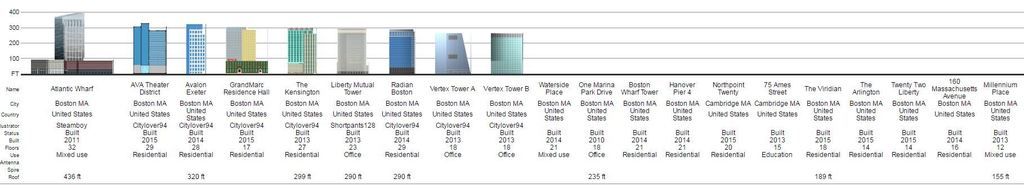

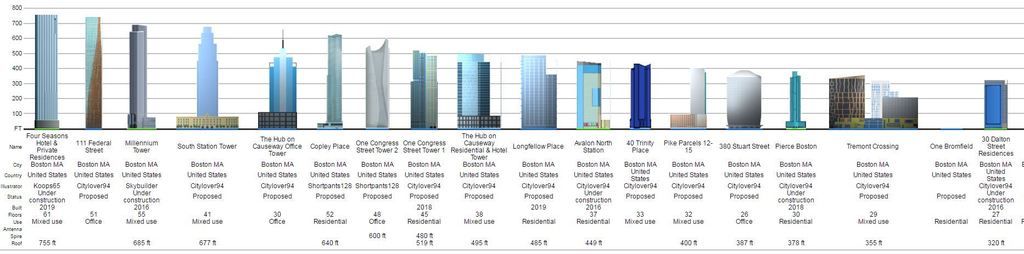

One significant difference about Boston? The Seaport. For quirky historical reasons, as recently as a decade ago Boston had acres upon acres of large footprint open space waiting for development within walking distance of downtown! All those new chunky buildings that many on this forum love to hate provide a TON of new space to absorb, they are essentially within a par five of South Station, and they cost a LOT less to build on a psf basis than the supertalls many would wish for. When all that space is gobbled up ... maybe by the next cycle ... the economics of taller may look more attractive. Our peer cities may have some virgin development territory on their fringes, but not so much, so close.

Ditto air rights: the downfall of Columbus Center wasn't the stupid NIMBYs like Ned or the fecklessness of the BRA or the capacity of Dianne Wilkerson's bra, it was the economic downturn combined with the sheer expense and risk of building over an active interstate highway. The Beal/Related team ... who built the successful Clarendon about fifty feet away ... had a looksie at the proposal after the original financing fell through and punted. They aren't negative on Boston - look at Lovejoy Wharf. But what's the point of tying yourself in knots with an incredibly difficult build over a highway when there are still choice development parcels on terra firma just a few blocks away? When Stuart Street is fully built out, over the Pike may also look a lot better. This overdue build-out of Back Bay Station is an encouraging sign.

I don't mean to suggest that the NIMBY element isn't annoying or pernicious, but I think many here overestimate the downtown neighborhoods' powers, ESPECIALLY under this mayor. I've had a window seat to two decades' worth of development proposal reviews and after a while the kabuki becomes routine. The lightning fast pivot on the Dainty Dot/Radian was a great example. Lopping off a few stories from the initial massing study is often a "sleeves off my vest" concession wherein the developer winds up with something even more profitable than the trial balloon and probably quite close to what his spreadsheet suggested in the first place. It's all about the Benjamins, not the postcard views, and in Boston 2016 these medium-tall buildings pencil out very well.