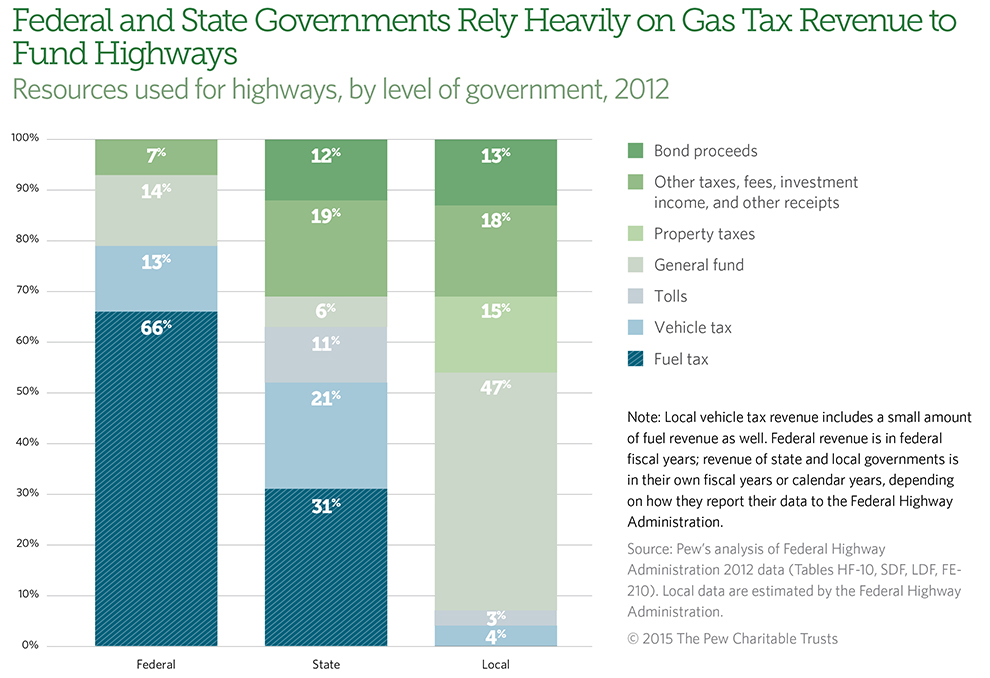

Brookings study says only 40% to 60% of road spending is paid for by user fees (state&fed&local fuel taxes, truck tire tax, tolls) depending on the jurisdiction and the road(and if it is tolled). The rest comes from real estate taxes (for city/county roads) and general revenues (income tax and sales taxes for state level spending).

So drivers get about the same subsidy (a dollar of subsidy for each dollar of user fee) that Bus and Subway riders do (whose fare pay about half the cost of their rides).

Further, to the extent that all consumers pay indirectly for truck taxes (that deliver stuff we consume) and many vehicles in cities drive on very little Interstae (but pay fuel taxes that pay for Fed roads), Ronald Reagan thought it fair to lockbox 10% of fuel taxes to go to urban transit (where trucks burn a lot of gas but do not use as much road and even less "federal" road but still pay fed diesel tax). as traffic slows and cites grow, it's possible that a lockbox of 20% would be better

Your Federal gas tax would have to nearly triple or be 4x {in order to displace sales/income/property taxes and make it be true that} our "motorist" taxes pay for road spending.

Worse, the roads are being worn out by drivers faster than we spend to replace them {this is the "crumbling infrastructure" problem...it is falling apart faster than we pay to fix it and demolish-rebuild at the end of design-life costs more than greenfield construction did in the 60s/70s/80s} So for "road fees" to pay the full replacement cost of what car/trucks are using/depreciating, I think the estimate was that fed gas tax would have to be 5x or 6x what they are.

Finally bus (and bikes) impose relatively little wear-per-taxpayer on the roads (we pay our state sales and income taxes) but from a wear-pound-mile standpoint we consume less road than our non-gas taxes are paying for, subsidizing SOV commuters and trucks

Arlington -- Please don't obfuscate -- we are not talking town and city roads as they are common thoroughfares for:

people, dogs, cats, bikes, electric scooters, an occasional horse, Teslas, Leafs, buses, taxis, trucks, the occasional parade, and in Lexington the occasional Llama

What the car haters are always talking about in the suburbanization versus their urban utopia debate is

Highways whose access is limited to motor vehicles

Those Highways get very little funding from real estate taxes [towns and cities very rarely build or maintain them] == they are paid for almost entirely by the drivers who use them through the state and federal fuel tax, highway tolls and various licences and fees

and forget Brookings -- we are only interested in what happens in Massachusetts

So why not go to the source Commonwealth of Massachusetts FY2016 [as enacted, signed sealed and delivered] [in thousands $]:

Transportation 643,578

DEPARTMENT OF TRANSPORTATION 704,865,801 total budgeted spending [in $]

Section 2E

- 1595-6368 Massachusetts Transportation Trust Fund

For an operating transfer to the Massachusetts Transportation Trust Fund established in section 4 of chapter 6C of the General Laws; ..... 365,025,340

- 1595-6369 Commonwealth Transportation Fund transfer to the MBTA

For an operating transfer to the Massachusetts Bay Transportation Authority pursuant to clause ...... 187,000,000

- 1595-6370 Commonwealth Transportation Fund transfer to Regional Transit

For an operating transfer to the regional transit authorities organized pursuant to chapter 161B of the General Laws or predecessor statutes pursuant to clause .... 82,000,000

- 1595-6379 Merit Rating Board

For the operation of the motor vehicle insurance merit rating board, including the rent, related parking and utility expenses of the board; provided ... 9,553,119

Money comes from a from a number of sources but principally Federal Grants for specific construction projects and transfers from the Massachusetts Transportation Trust Fund [specified in very bureaucratic and obscure manner] in the following document [excerpt follows]

https://malegislature.gov/Laws/GeneralLaws/PartI/TitleII/Chapter6C/Section4

Section 4. There shall be established and placed within the department a separate fund to be known as the Massachusetts Transportation Trust Fund which shall be used for financing transportation-related purposes of the Massachusetts Department of Transportation.

The secretary shall be authorized to enter into agreements with the Massachusetts Bay Transportation Authority, the Massachusetts Port Authority, the regional transit authorities and, for so long as it shall continue to exist, the Massachusetts Turnpike Authority to commit any funds generated from fares, fees, tolls or any other revenue sources including, but not limited to, from federal sources of these authorities to the fund. There shall be credited to the fund all turnpike revenues and other toll and non-toll revenue collected by the department after assumption of the assets, obligations and liabilities of the Massachusetts Turnpike Authority, all tolls collected by the department after transfer of the Maurice J. Tobin Memorial Bridge by the Massachusetts Port Authority to the department, all refunds and rebates made on account of expenditures on ways by the department, any revenues from appropriations or other monies authorized by the general court and specifically designated to be credited to the fund, any gifts, grants, private contributions, investment income earned on the fund's assets, all monies received by the department for the sale or lease of property, all monies received by the department in satisfaction of claims by the department for damage to highway and bridge safety signs, signals, guardrails, curbing and other highway and bridge related facilities, and other receipts of the department. Money remaining in the fund at the end of the year shall not revert to the General Fund.

and the aforementioned Federal Grants which go directly to the projects

Federal Grant Spending 61,287,342 which is not part of the Mass Budget appropriation

- 6440-0088 Perform Registry Information System Management

For the purposes of a federally funded grant entitled, Performance Registry Information System Management 80,473

- 6440-0089 Commercial Vehicle Information Systems and Networks

For the purposes of a federally funded grant entitled, Commercial Vehicle Information Systems and Networks 200,000

- 6440-0090 Commercial Driver License Information System Enhancement

For the purposes of a federally funded grant entitled, Commercial Drivers Licenses Information System Enhancement 298,998

- 6440-0097 Commercial Driver License Information System

For the purposes of a federally funded grant entitled, Commercial Drivers License Information System Modernization Program 87,600

- 6440-0098 Safety Data Improvement Program

For the purposes of a federally funded grant entitled, Real ID Demonstration Program 457,742

- 6440-0099 Real ID Demonstration Grant Program

For the purposes of a federally funded grant entitled, Safety Data Improvement Program 485,433

- 6642-0018 Nonurbanized Area Formula Program

For the purposes of a federally funded grant entitled, Non-Urbanized Area Formula Program 3,762,374

- 6642-0020 Job Access and Reverse Commute

For the purposes of a federally funded grant entitled, Job Access and Reverse Commute 2,000,000

- 6642-0023 Metropolitan Transportation Planning

For the purposes of a federally funded grant entitled, Metropolitan Transportation Planning 3,432,390

- 6642-0026 New Freedom Operating Segment

For the purposes of a federally funded grant entitled, New Freedom Operating Segment 1,000,000

- 6642-0029 BusPlus Replacement Program

For the purposes of a federally funded grant entitled, Bus Plus Replacement and Springfield Union Station ITC Section 5309 15,535,802

- 6642-0030 Transit Grant Bus and Bus Facilities

For the purposes of a federally funded grant entitled, Bus and Bus Facilities Section 5339 942,000

- 6642-0049 Special Needs for Elderly Individuals

For the purposes of a federally funded grant entitled, Special Needs for Elderly Individuals 5,500,000

- 6643-0012 Knowledge Corridor Restore Vermonter Project - ARRA

For the purposes of a federally funded grant entitled, ARRA Knowledge Corridor Restore Vermonter Project 15,310,130

- 6643-0013 Boston South Station Expansion

For the purposes of a federally funded grant entitled, Boston South Station Expansion 10,000,000

- 6643-0014 High Speed Rail Corridor Feasibility and Planning

For the purposes of a federally funded grant entitled, Inland Route High Speed Rail Corridor Feasibility and Planning 694,400

- 6643-0015 Patriot Corridor Double Stack Clearance Initiative

For the purposes of a federally funded grant entitled, Patriot Corridor Double-Stack Clearance Initiative 1,500,000

When all is said and done the bottom line is the $187M transfer to the MBTA over and above the normal sources of funds dedicated to the MBTA