You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Occupy Wall St/Boston

- Thread starter kmp1284

- Start date

TheRifleman

Banned

- Joined

- Sep 25, 2008

- Messages

- 4,431

- Reaction score

- 0

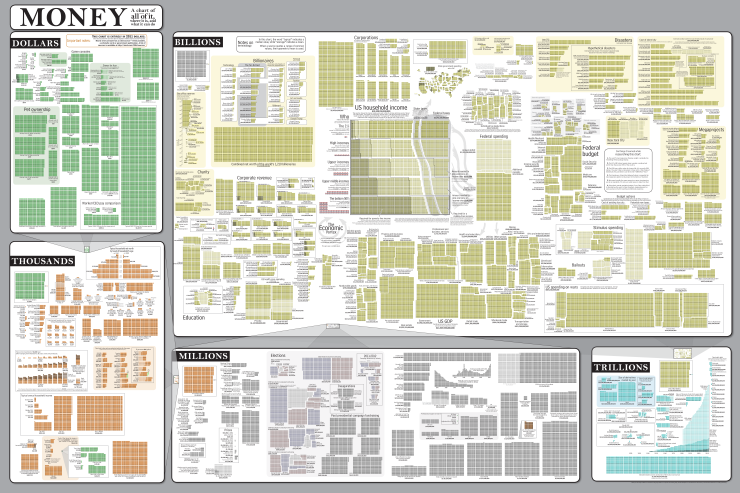

^^^^^ GREAT CHART

Actually I heard the Rothchild Family networth is something in the Trillions? They make the rules and tell the puppets what and how to regulate.

If the Teaparty was well organized they would open camp on the other side of the Greenway. How fast would our hypocritical Mayor flip flop on free democracy.

Actually I heard the Rothchild Family networth is something in the Trillions? They make the rules and tell the puppets what and how to regulate.

If the Teaparty was well organized they would open camp on the other side of the Greenway. How fast would our hypocritical Mayor flip flop on free democracy.

BostonUrbEx

Senior Member

- Joined

- Mar 13, 2010

- Messages

- 4,340

- Reaction score

- 130

"The Eisenhower Interstate Highway System is arguably the most expensive public works project in the history of mankind."

And what do we get? Pollution, asthma, obesity, and dysfunctional cities.

And what do we get? Pollution, asthma, obesity, and dysfunctional cities.

Lurker

Senior Member

- Joined

- Jun 13, 2006

- Messages

- 2,362

- Reaction score

- 0

^^^^^ GREAT CHART

Actually I heard the Rothchild Family networth is something in the Trillions? They make the rules and tell the puppets what and how to regulate.

And the Queen of England really is a drug kingpin. You're off in tinfoil hat territory now Chuck Connors.

Lurker

Senior Member

- Joined

- Jun 13, 2006

- Messages

- 2,362

- Reaction score

- 0

I vehemently deny any involvement in the Police Academy series and will treat any further accusations as libelous slander. Any further additional formal inquiries can be referred to my high powered legal department.. I mean my wife.

TheRifleman

Banned

- Joined

- Sep 25, 2008

- Messages

- 4,431

- Reaction score

- 0

So the Federal Reserve bailed out the Banks 7.7 Trillion dollars of free interest loans that are on the backs of the American Taxpayer and working class.

This type of debt load will break American workers financial freedom.

http://www.bloomberg.com/news/2011-...congress-gave-banks-13-billion-in-income.html

This type of debt load will break American workers financial freedom.

Secret Fed Loans Gave Banks $13 Billion

QBy Bob Ivry, Bradley Keoun and Phil Kuntz - Nov 27, 2011 7:01 PM ET Bloomberg Markets Magazine.

inShare.1,290

More

Business ExchangeBuzz up!DiggPrint Email ..Enlarge image

Jamie Dimon Tomohiro Ohsumi/Bloomberg

James "Jamie" Dimon, chairman and chief executive officer of JPMorgan Chase & Co., participates in a session on the second day of the World Economic Forum (WEF) Annual Meeting 2011 in Davos, Switzerland, on Thursday, Jan. 27, 2011.

James "Jamie" Dimon, chairman and chief executive officer of JPMorgan Chase & Co., participates in a session on the second day of the World Economic Forum (WEF) Annual Meeting 2011 in Davos, Switzerland, on Thursday, Jan. 27, 2011. Photographer: Tomohiro Ohsumi/Bloomberg

Play Video

QNov. 28 (Bloomberg) -- Bloomberg Markets magazine's January issue examines how the Federal Reserve and big banks fought for more than two years to keep details of the largest bailout in U.S. history a secret. And how bankers failed to mention that they took tens of billions of dollars in emergency loans at the same time they were assuring investors their firms were healthy. (Source: Bloomberg)

Play Video

QNov. 28 (Bloomberg) -- The Federal Reserve and the big banks fought for more than two years to keep details of the largest bailout in U.S. history a secret. No one calculated until now that banks reaped an estimated $13 billion of income by taking advantage of the Fed’s below-market rates, Bloomberg Markets magazine reports in its January issue. Betty Liu reports on Bloomberg Television's "In the Loop." (Source: Bloomberg)

Enlarge image

Kenneth D. Lewis Former CEO of Bank of America Corp.

On Nov. 26, 2008, then-Bank of America Corp. Chief Executive Officer Kenneth D. Lewis wrote to shareholders that he headed “one of the strongest and most stable major banks in the world.” He didn’t say that his firm owed the central bank $86 billion that day. Photo: Joshua Roberts/Bloomberg

On Nov. 26, 2008, then-Bank of America Corp. Chief Executive Officer Kenneth D. Lewis wrote to shareholders that he headed “one of the strongest and most stable major banks in the world.” He didn’t say that his firm owed the central bank $86 billion that day. Photo: Joshua Roberts/Bloomberg

.The Federal Reserve and the big banks fought for more than two years to keep details of the largest bailout in U.S. history a secret. Now, the rest of the world can see what it was missing.

The Fed didn’t tell anyone which banks were in trouble so deep they required a combined $1.2 trillion on Dec. 5, 2008, their single neediest day. Bankers didn’t mention that they took tens of billions of dollars in emergency loans at the same time they were assuring investors their firms were healthy. And no one calculated until now that banks reaped an estimated $13 billion of income by taking advantage of the Fed’s below-market rates, Bloomberg Markets magazine reports in its January issue.

Saved by the bailout, bankers lobbied against government regulations, a job made easier by the Fed, which never disclosed the details of the rescue to lawmakers even as Congress doled out more money and debated new rules aimed at preventing the next collapse.

A fresh narrative of the financial crisis of 2007 to 2009 emerges from 29,000 pages of Fed documents obtained under the Freedom of Information Act and central bank records of more than 21,000 transactions. While Fed officials say that almost all of the loans were repaid and there have been no losses, details suggest taxpayers paid a price beyond dollars as the secret funding helped preserve a broken status quo and enabled the biggest banks to grow even bigger.

‘Change Their Votes’

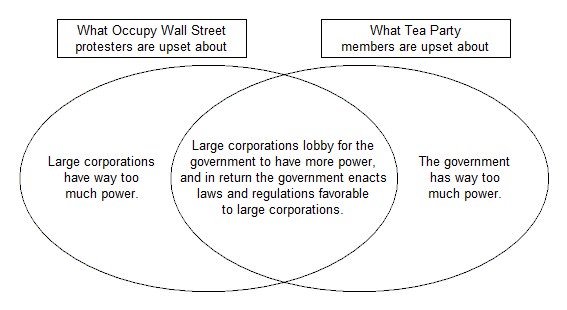

“When you see the dollars the banks got, it’s hard to make the case these were successful institutions,” says Sherrod Brown, a Democratic Senator from Ohio who in 2010 introduced an unsuccessful bill to limit bank size. “This is an issue that can unite the Tea Party and Occupy Wall Street. There are lawmakers in both parties who would change their votes now.”

The size of the bailout came to light after Bloomberg LP, the parent of Bloomberg News, won a court case against the Fed and a group of the biggest U.S. banks called Clearing House Association LLC to force lending details into the open.

The Fed, headed by Chairman Ben S. Bernanke, argued that revealing borrower details would create a stigma -- investors and counterparties would shun firms that used the central bank as lender of last resort -- and that needy institutions would be reluctant to borrow in the next crisis. Clearing House Association fought Bloomberg’s lawsuit up to the U.S. Supreme Court, which declined to hear the banks’ appeal in March 2011.

$7.77 Trillion

The amount of money the central bank parceled out was surprising even to Gary H. Stern, president of the Federal Reserve Bank of Minneapolis from 1985 to 2009, who says he “wasn’t aware of the magnitude.” It dwarfed the Treasury Department’s better-known $700 billion Troubled Asset Relief Program, or TARP. Add up guarantees and lending limits, and the Fed had committed $7.77 trillion as of March 2009 to rescuing the financial system, more than half the value of everything produced in the U.S. that year.

“TARP at least had some strings attached,” says Brad Miller, a North Carolina Democrat on the House Financial Services Committee, referring to the program’s executive-pay ceiling. “With the Fed programs, there was nothing.”

Bankers didn’t disclose the extent of their borrowing. On Nov. 26, 2008, then-Bank of America (BAC) Corp. Chief Executive Officer Kenneth D. Lewis wrote to shareholders that he headed “one of the strongest and most stable major banks in the world.” He didn’t say that his Charlotte, North Carolina-based firm owed the central bank $86 billion that day.

‘Motivate Others’

JPMorgan Chase & Co. CEO Jamie Dimon told shareholders in a March 26, 2010, letter that his bank used the Fed’s Term Auction Facility “at the request of the Federal Reserve to help motivate others to use the system.” He didn’t say that the New York-based bank’s total TAF borrowings were almost twice its cash holdings or that its peak borrowing of $48 billion on Feb. 26, 2009, came more than a year after the program’s creation.

Howard Opinsky, a spokesman for JPMorgan (JPM), declined to comment about Dimon’s statement or the company’s Fed borrowings. Jerry Dubrowski, a spokesman for Bank of America, also declined to comment.

The Fed has been lending money to banks through its so- called discount window since just after its founding in 1913. Starting in August 2007, when confidence in banks began to wane, it created a variety of ways to bolster the financial system with cash or easily traded securities. By the end of 2008, the central bank had established or expanded 11 lending facilities catering to banks, securities firms and corporations that couldn’t get short-term loans from their usual sources.

‘Core Function’

“Supporting financial-market stability in times of extreme market stress is a core function of central banks,” says William B. English, director of the Fed’s Division of Monetary Affairs. “Our lending programs served to prevent a collapse of the financial system and to keep credit flowing to American families and businesses.”

The Fed has said that all loans were backed by appropriate collateral. That the central bank didn’t lose money should “lead to praise of the Fed, that they took this extraordinary step and they got it right,” says Phillip Swagel, a former assistant Treasury secretary under Henry M. Paulson and now a professor of international economic policy at the University of Maryland.

The Fed initially released lending data in aggregate form only. Information on which banks borrowed, when, how much and at what interest rate was kept from public view.

The secrecy extended even to members of President George W. Bush’s administration who managed TARP. Top aides to Paulson weren’t privy to Fed lending details during the creation of the program that provided crisis funding to more than 700 banks, say two former senior Treasury officials who requested anonymity because they weren’t authorized to speak.

Big Six

The Treasury Department relied on the recommendations of the Fed to decide which banks were healthy enough to get TARP money and how much, the former officials say. The six biggest U.S. banks, which received $160 billion of TARP funds, borrowed as much as $460 billion from the Fed, measured by peak daily debt calculated by Bloomberg using data obtained from the central bank. Paulson didn’t respond to a request for comment.

The six -- JPMorgan, Bank of America, Citigroup Inc. (C), Wells Fargo & Co. (WFC), Goldman Sachs Group Inc. (GS) and Morgan Stanley -- accounted for 63 percent of the average daily debt to the Fed by all publicly traded U.S. banks, money managers and investment- services firms, the data show. By comparison, they had about half of the industry’s assets before the bailout, which lasted from August 2007 through April 2010. The daily debt figure excludes cash that banks passed along to money-market funds.

Bank Supervision

While the emergency response prevented financial collapse, the Fed shouldn’t have allowed conditions to get to that point, says Joshua Rosner, a banking analyst with Graham Fisher & Co. in New York who predicted problems from lax mortgage underwriting as far back as 2001. The Fed, the primary supervisor for large financial companies, should have been more vigilant as the housing bubble formed, and the scale of its lending shows the “supervision of the banks prior to the crisis was far worse than we had imagined,” Rosner says.

Bernanke in an April 2009 speech said that the Fed provided emergency loans only to “sound institutions,” even though its internal assessments described at least one of the biggest borrowers, Citigroup, as “marginal.”

On Jan. 14, 2009, six days before the company’s central bank loans peaked, the New York Fed gave CEO Vikram Pandit a report declaring Citigroup’s financial strength to be “superficial,” bolstered largely by its $45 billion of Treasury funds. The document was released in early 2011 by the Financial Crisis Inquiry Commission, a panel empowered by Congress to probe the causes of the crisis.

‘Need Transparency’

Andrea Priest, a spokeswoman for the New York Fed, declined to comment, as did Jon Diat, a spokesman for Citigroup.

“I believe that the Fed should have independence in conducting highly technical monetary policy, but when they are putting taxpayer resources at risk, we need transparency and accountability,” says Alabama Senator Richard Shelby, the top Republican on the Senate Banking Committee.

Judd Gregg, a former New Hampshire senator who was a lead Republican negotiator on TARP, and Barney Frank, a Massachusetts Democrat who chaired the House Financial Services Committee, both say they were kept in the dark.

“We didn’t know the specifics,” says Gregg, who’s now an adviser to Goldman Sachs.

“We were aware emergency efforts were going on,” Frank says. “We didn’t know the specifics.”

Disclose Lending

Frank co-sponsored the Dodd-Frank Wall Street Reform and Consumer Protection Act, billed as a fix for financial-industry excesses. Congress debated that legislation in 2010 without a full understanding of how deeply the banks had depended on the Fed for survival.

It would have been “totally appropriate” to disclose the lending data by mid-2009, says David Jones, a former economist at the Federal Reserve Bank of New York who has written four books about the central bank.

“The Fed is the second-most-important appointed body in the U.S., next to the Supreme Court, and we’re dealing with a democracy,” Jones says. “Our representatives in Congress deserve to have this kind of information so they can oversee the Fed.”

The Dodd-Frank law required the Fed to release details of some emergency-lending programs in December 2010. It also mandated disclosure of discount-window borrowers after a two- year lag.

Protecting TARP

TARP and the Fed lending programs went “hand in hand,” says Sherrill Shaffer, a banking professor at the University of Wyoming in Laramie and a former chief economist at the New York Fed. While the TARP money helped insulate the central bank from losses, the Fed’s willingness to supply seemingly unlimited financing to the banks assured they wouldn’t collapse, protecting the Treasury’s TARP investments, he says.

“Even though the Treasury was in the headlines, the Fed was really behind the scenes engineering it,” Shaffer says.

Congress, at the urging of Bernanke and Paulson, created TARP in October 2008 after the bankruptcy of Lehman Brothers Holdings Inc. made it difficult for financial institutions to get loans. Bank of America and New York-based Citigroup each received $45 billion from TARP. At the time, both were tapping the Fed. Citigroup hit its peak borrowing of $99.5 billion in January 2009, while Bank of America topped out in February 2009 at $91.4 billion.

No Clue

Lawmakers knew none of this.

They had no clue that one bank, New York-based Morgan Stanley (MS), took $107 billion in Fed loans in September 2008, enough to pay off one-tenth of the country’s delinquent mortgages. The firm’s peak borrowing occurred the same day Congress rejected the proposed TARP bill, triggering the biggest point drop ever in the Dow Jones Industrial Average. (INDU) The bill later passed, and Morgan Stanley got $10 billion of TARP funds, though Paulson said only “healthy institutions” were eligible.

Mark Lake, a spokesman for Morgan Stanley, declined to comment, as did spokesmen for Citigroup and Goldman Sachs.

Had lawmakers known, it “could have changed the whole approach to reform legislation,” says Ted Kaufman, a former Democratic Senator from Delaware who, with Brown, introduced the bill to limit bank size.

Moral Hazard

Kaufman says some banks are so big that their failure could trigger a chain reaction in the financial system. The cost of borrowing for so-called too-big-to-fail banks is lower than that of smaller firms because lenders believe the government won’t let them go under. The perceived safety net creates what economists call moral hazard -- the belief that bankers will take greater risks because they’ll enjoy any profits while shifting losses to taxpayers.

If Congress had been aware of the extent of the Fed rescue, Kaufman says, he would have been able to line up more support for breaking up the biggest banks.

Byron L. Dorgan, a former Democratic senator from North Dakota, says the knowledge might have helped pass legislation to reinstate the Glass-Steagall Act, which for most of the last century separated customer deposits from the riskier practices of investment banking.

“Had people known about the hundreds of billions in loans to the biggest financial institutions, they would have demanded Congress take much more courageous actions to stop the practices that caused this near financial collapse,” says Dorgan, who retired in January.

Getting Bigger

Instead, the Fed and its secret financing helped America’s biggest financial firms get bigger and go on to pay employees as much as they did at the height of the housing bubble.

Total assets held by the six biggest U.S. banks increased 39 percent to $9.5 trillion on Sept. 30, 2011, from $6.8 trillion on the same day in 2006, according to Fed data.

For so few banks to hold so many assets is “un-American,” says Richard W. Fisher, president of the Federal Reserve Bank of Dallas. “All of these gargantuan institutions are too big to regulate. I’m in favor of breaking them up and slimming them down.”

Employees at the six biggest banks made twice the average for all U.S. workers in 2010, based on Bureau of Labor Statistics hourly compensation cost data. The banks spent $146.3 billion on compensation in 2010, or an average of $126,342 per worker, according to data compiled by Bloomberg. That’s up almost 20 percent from five years earlier compared with less than 15 percent for the average worker. Average pay at the banks in 2010 was about the same as in 2007, before the bailouts.

‘Wanted to Pretend’

“The pay levels came back so fast at some of these firms that it appeared they really wanted to pretend they hadn’t been bailed out,” says Anil Kashyap, a former Fed economist who’s now a professor of economics at the University of Chicago Booth School of Business. “They shouldn’t be surprised that a lot of people find some of the stuff that happened totally outrageous.”

Bank of America took over Merrill Lynch & Co. at the urging of then-Treasury Secretary Paulson after buying the biggest U.S. home lender, Countrywide Financial Corp. When the Merrill Lynch purchase was announced on Sept. 15, 2008, Bank of America had $14.4 billion in emergency Fed loans and Merrill Lynch had $8.1 billion. By the end of the month, Bank of America’s loans had reached $25 billion and Merrill Lynch’s had exceeded $60 billion, helping both firms keep the deal on track.

Prevent Collapse

Wells Fargo bought Wachovia Corp., the fourth-largest U.S. bank by deposits before the 2008 acquisition. Because depositors were pulling their money from Wachovia, the Fed channeled $50 billion in secret loans to the Charlotte, North Carolina-based bank through two emergency-financing programs to prevent collapse before Wells Fargo could complete the purchase.

“These programs proved to be very successful at providing financial markets the additional liquidity and confidence they needed at a time of unprecedented uncertainty,” says Ancel Martinez, a spokesman for Wells Fargo.

JPMorgan absorbed the country’s largest savings and loan, Seattle-based Washington Mutual Inc., and investment bank Bear Stearns Cos. The New York Fed, then headed by Timothy F. Geithner, who’s now Treasury secretary, helped JPMorgan complete the Bear Stearns deal by providing $29 billion of financing, which was disclosed at the time. The Fed also supplied Bear Stearns with $30 billion of secret loans to keep the company from failing before the acquisition closed, central bank data show. The loans were made through a program set up to provide emergency funding to brokerage firms.

‘Regulatory Discretion’

“Some might claim that the Fed was picking winners and losers, but what the Fed was doing was exercising its professional regulatory discretion,” says John Dearie, a former speechwriter at the New York Fed who’s now executive vice president for policy at the Financial Services Forum, a Washington-based group consisting of the CEOs of 20 of the world’s biggest financial firms. “The Fed clearly felt it had what it needed within the requirements of the law to continue to lend to Bear and Wachovia.”

The bill introduced by Brown and Kaufman in April 2010 would have mandated shrinking the six largest firms.

“When a few banks have advantages, the little guys get squeezed,” Brown says. “That, to me, is not what capitalism should be.”

Kaufman says he’s passionate about curbing too-big-to-fail banks because he fears another crisis.

‘Can We Survive?’

“The amount of pain that people, through no fault of their own, had to endure -- and the prospect of putting them through it again -- is appalling,” Kaufman says. “The public has no more appetite for bailouts. What would happen tomorrow if one of these big banks got in trouble? Can we survive that?”

Lobbying expenditures by the six banks that would have been affected by the legislation rose to $29.4 million in 2010 compared with $22.1 million in 2006, the last full year before credit markets seized up -- a gain of 33 percent, according to OpenSecrets.org, a research group that tracks money in U.S. politics. Lobbying by the American Bankers Association, a trade organization, increased at about the same rate, OpenSecrets.org reported.

Lobbyists argued the virtues of bigger banks. They’re more stable, better able to serve large companies and more competitive internationally, and breaking them up would cost jobs and cause “long-term damage to the U.S. economy,” according to a Nov. 13, 2009, letter to members of Congress from the FSF.

The group’s website cites Nobel Prize-winning economist Oliver E. Williamson, a professor emeritus at the University of California, Berkeley, for demonstrating the greater efficiency of large companies.

‘Serious Burden’

In an interview, Williamson says that the organization took his research out of context and that efficiency is only one factor in deciding whether to preserve too-big-to-fail banks.

“The banks that were too big got even bigger, and the problems that we had to begin with are magnified in the process,” Williamson says. “The big banks have incentives to take risks they wouldn’t take if they didn’t have government support. It’s a serious burden on the rest of the economy.”

Dearie says his group didn’t mean to imply that Williamson endorsed big banks.

Top officials in President Barack Obama’s administration sided with the FSF in arguing against legislative curbs on the size of banks.

Geithner, Kaufman

On May 4, 2010, Geithner visited Kaufman in his Capitol Hill office. As president of the New York Fed in 2007 and 2008, Geithner helped design and run the central bank’s lending programs. The New York Fed supervised four of the six biggest U.S. banks and, during the credit crunch, put together a daily confidential report on Wall Street’s financial condition. Geithner was copied on these reports, based on a sampling of e- mails released by the Financial Crisis Inquiry Commission.

At the meeting with Kaufman, Geithner argued that the issue of limiting bank size was too complex for Congress and that people who know the markets should handle these decisions, Kaufman says. According to Kaufman, Geithner said he preferred that bank supervisors from around the world, meeting in Basel, Switzerland, make rules increasing the amount of money banks need to hold in reserve. Passing laws in the U.S. would undercut his efforts in Basel, Geithner said, according to Kaufman.

Anthony Coley, a spokesman for Geithner, declined to comment.

‘Punishing Success’

Lobbyists for the big banks made the winning case that forcing them to break up was “punishing success,” Brown says. Now that they can see how much the banks were borrowing from the Fed, senators might think differently, he says.

The Fed supported curbing too-big-to-fail banks, including giving regulators the power to close large financial firms and implementing tougher supervision for big banks, says Fed General Counsel Scott G. Alvarez. The Fed didn’t take a position on whether large banks should be dismantled before they get into trouble.

Dodd-Frank does provide a mechanism for regulators to break up the biggest banks. It established the Financial Stability Oversight Council that could order teetering banks to shut down in an orderly way. The council is headed by Geithner.

“Dodd-Frank does not solve the problem of too big to fail,” says Shelby, the Alabama Republican. “Moral hazard and taxpayer exposure still very much exist.”

Below Market

Dean Baker, co-director of the Center for Economic and Policy Research in Washington, says banks “were either in bad shape or taking advantage of the Fed giving them a good deal. The former contradicts their public statements. The latter -- getting loans at below-market rates during a financial crisis -- is quite a gift.”

The Fed says it typically makes emergency loans more expensive than those available in the marketplace to discourage banks from abusing the privilege. During the crisis, Fed loans were among the cheapest around, with funding available for as low as 0.01 percent in December 2008, according to data from the central bank and money-market rates tracked by Bloomberg.

The Fed funds also benefited firms by allowing them to avoid selling assets to pay investors and depositors who pulled their money. So the assets stayed on the banks’ books, earning interest.

Banks report the difference between what they earn on loans and investments and their borrowing expenses. The figure, known as net interest margin, provides a clue to how much profit the firms turned on their Fed loans, the costs of which were included in those expenses. To calculate how much banks stood to make, Bloomberg multiplied their tax-adjusted net interest margins by their average Fed debt during reporting periods in which they took emergency loans.

Added Income

The 190 firms for which data were available would have produced income of $13 billion, assuming all of the bailout funds were invested at the margins reported, the data show.

The six biggest U.S. banks’ share of the estimated subsidy was $4.8 billion, or 23 percent of their combined net income during the time they were borrowing from the Fed. Citigroup would have taken in the most, with $1.8 billion.

“The net interest margin is an effective way of getting at the benefits that these large banks received from the Fed,” says Gerald A. Hanweck, a former Fed economist who’s now a finance professor at George Mason University in Fairfax, Virginia.

While the method isn’t perfect, it’s impossible to state the banks’ exact profits or savings from their Fed loans because the numbers aren’t disclosed and there isn’t enough publicly available data to figure it out.

Opinsky, the JPMorgan spokesman, says he doesn’t think the calculation is fair because “in all likelihood, such funds were likely invested in very short-term investments,” which typically bring lower returns.

Standing Access

Even without tapping the Fed, the banks get a subsidy by having standing access to the central bank’s money, says Viral Acharya, a New York University economics professor who has worked as an academic adviser to the New York Fed.

“Banks don’t give lines of credit to corporations for free,” he says. “Why should all these government guarantees and liquidity facilities be for free?”

In the September 2008 meeting at which Paulson and Bernanke briefed lawmakers on the need for TARP, Bernanke said that if nothing was done, “unemployment would rise -- to 8 or 9 percent from the prevailing 6.1 percent,” Paulson wrote in “On the Brink” (Business Plus, 2010).

Occupy Wall Street

The U.S. jobless rate hasn’t dipped below 8.8 percent since March 2009, 3.6 million homes have been foreclosed since August 2007, according to data provider RealtyTrac Inc., and police have clashed with Occupy Wall Street protesters, who say government policies favor the wealthiest citizens, in New York, Boston, Seattle and Oakland, California.

The Tea Party, which supports a more limited role for government, has its roots in anger over the Wall Street bailouts, says Neil M. Barofsky, former TARP special inspector general and a Bloomberg Television contributing editor.

“The lack of transparency is not just frustrating; it really blocked accountability,” Barofsky says. “When people don’t know the details, they fill in the blanks. They believe in conspiracies.”

In the end, Geithner had his way. The Brown-Kaufman proposal to limit the size of banks was defeated, 60 to 31. Bank supervisors meeting in Switzerland did mandate minimum reserves that institutions will have to hold, with higher levels for the world’s largest banks, including the six biggest in the U.S. Those rules can be changed by individual countries.

They take full effect in 2019.

Meanwhile, Kaufman says, “we’re absolutely, totally, 100 percent not prepared for another financial crisis.”

http://www.bloomberg.com/news/2011-...congress-gave-banks-13-billion-in-income.html

Last edited:

JohnAKeith

Senior Member

- Joined

- Dec 24, 2008

- Messages

- 4,337

- Reaction score

- 82

You lost me at "So ..."

Joking!

Joking!

BostonUrbEx

Senior Member

- Joined

- Mar 13, 2010

- Messages

- 4,340

- Reaction score

- 130

TheRifleman

Banned

- Joined

- Sep 25, 2008

- Messages

- 4,431

- Reaction score

- 0

........The Silver Rush at MF Global

OWS might want to take notes on this one.

This guy Corizine is a real piece of work. I hope everyone has their assets in order.

http://finance.yahoo.com/news/the-silver-rush-at-mf-global-.html

By Erin Arvedlund | Barrons.com – 2 hours 15 minutes ago

....

Investors are furious that they can't get back the gold and silver they stashed with the failed brokerage.

It's one thing for $1.2 billion to vanish into thin air through a series of complex trades, the well-publicized phenomenon at bankrupt MF Global. It's something else for a bar of silver stashed in a vault to instantly shrink in size by more than 25%.

That, in essence, is what's happening to investors whose bars of silver and gold were held through accounts with MF Global.

The trustee overseeing the liquidation of the failed brokerage has proposed dumping all remaining customer assets—gold, silver, cash, options, futures and commodities—into a single pool that would pay customers only 72% of the value of their holdings. In other words, while traders already may have paid the full price for delivery of specific bars of gold or silver—and hold "warehouse receipts" to prove it—they'll have to forfeit 28% of the value.

That has investors fuming. "Warehouse receipts, like gold bars, are our property, 100%," contends John Roe, a partner in BTR Trading, a Chicago futures-trading firm. He personally lost several hundred thousand dollars in investments via MF Global; his clients lost even more. "We are a unique class, and instead, the trustee is doing a radical redistribution of property," he says.

Roe and others point out that, unlike other MF Global customers, who held paper assets, those with warehouse receipts have claims on assets that still exist and can be readily identified.

The tussle has been obscured by former CEO Jon Corzine's appearances on Capitol Hill. But it's a burning issue for the Commodity Customer Coalition, a group that says it represents some 8,000 investors—many of them hedge funds—with exposure to MF Global. "I've issued a declaration of war," says James Koutoulas, lead attorney for the group, and CEO of Typhon Capital Management.

At stake is an unspecified, but apparently large, volume of gold and silver bars slated for delivery to traders through accounts at MF Global, which filed for bankruptcy on Oct. 31. Adding insult to the injury: Of the 28% haircut, attorney and liquidation trustee James Giddens has frozen all asset classes, meaning that traders have sat helplessly as silver prices have dropped 31% since late August, and gold has fallen 16%. To boot, the traders are still being assessed fees for storage of the commodities.

Other kinds of problems are also surfacing. Investor Gerald Celente says he was hit with a big margin call when the gold contracts in his MF Global account were transferred to another brokerage. "I refused to put up more money," he explains, "so they closed out a number of my open positions at the current market price." The trustee, Giddens, couldn't be reached for comment for this story.

A substantial portion of MF Global's commodity clients cleared their transactions through the Chicago Mercantile Exchange and Comex, owned by CME Group (ticker: CME). The question now looming over CME's stock is whether the company will be liable for customer losses. CME, which also owns the Chicago Board of Trade and Chicago Board Options Exchange, runs markets for futures contracts and options on futures, interest rates, stock indexes, foreign exchange and actual commodities.

CME's stock, which had been as high as $327 over the past year, has slid to a recent $242 as a result of low trading volumes and uncertainty about the MF Global scandal.

The Customer Coalition may eventually press its case with the exchange operator. "If it turns out the only way we get customer money back is [to] go after the CME, then we'll go after the CME," says Koutoulas.

Trader John Cassimatis of Philadelphia, who was a large client of MF Global, is furious at CME, now that his contracts for silver bars are stuck under the control of the trustee. "Ultimately," he says, "they have failed to be the backstop, anywhere, anytime."

IT'S STILL UNCLEAR WHETHER CME will put its commodity-futures customers first—or its shareholders. The company has set aside a $550 million reserve for MF Global customers, and it has cash balances of more than $1.1 billion that it could tap, if needed. But CME Group's chief operating officer, Bryan Durkin, said last week that CME wouldn't guarantee the funds that remain missing from customer accounts at MF Global after they are reimbursed by the bankruptcy trustee. Such a move would be "unwise" and the CME has a "fiduciary responsibility" to its shareholders, Reuters quoted him as saying.

In congressional testimony last week, CME Executive Chairman Terrence Duffy pinned the blame squarely on MF Global, asserting that Corzine knew that untouchable, segregated customer funds had been used as collateral for loans. Corzine later denied Duffy's charge.

At a minimum, it all makes for an intriguing, although risky, play on CME stock.

ISI Group analyst Brian Bedell points out that the shares are changing hands at just 13 times estimated earnings for next year, a three-year low relative to the price/earnings ratio of the Standard & Poor's 500 Index. If the company dodges big payments to MF Global customers, the stock could be as good as gold.

E-mail: editors@barrons.com

OWS might want to take notes on this one.

This guy Corizine is a real piece of work. I hope everyone has their assets in order.

http://finance.yahoo.com/news/the-silver-rush-at-mf-global-.html

Lurker

Senior Member

- Joined

- Jun 13, 2006

- Messages

- 2,362

- Reaction score

- 0

Re: Liberty Mutual plans major Boston expansion

Can we drop the retread of the Bolshevik & Menshevik semantics in every development project post already? The contrived class warfare meme was already tired before the most recent regurgitation.

- Joined

- Sep 15, 2010

- Messages

- 8,894

- Reaction score

- 271

Re: Liberty Mutual plans major Boston expansion

Fair enough. Perhaps my comment poking fun at that exact issue arising in threads only contributed to it. I prematurely anticipated a comment that may or may not have been coming.

It comes down to this being a major Boston company undergoing a major expansion, which is great for the state of the city's economy.

Can we drop the retread of the Bolshevik & Menshevik semantics in every development project post already? The contrived class warfare meme was already tired before the most recent regurgitation.

Fair enough. Perhaps my comment poking fun at that exact issue arising in threads only contributed to it. I prematurely anticipated a comment that may or may not have been coming.

It comes down to this being a major Boston company undergoing a major expansion, which is great for the state of the city's economy.

Re: Liberty Mutual plans major Boston expansion

+1

Can we drop the retread of the Bolshevik & Menshevik semantics in every development project post already? The contrived class warfare meme was already tired before the most recent regurgitation.

+1

whighlander

Senior Member

- Joined

- Aug 14, 2006

- Messages

- 7,812

- Reaction score

- 647

Re: Liberty Mutual plans major Boston expansion

Data and the rest -- Punt the 1% BS -- there is only a single fraction of 1% that matters -- the brave men and women who put there lives on the line for the rest of us to be able to have this discussion at our leisure

For reference purposes -- there is nothing today like the concentration of wealth in the US the past:

in the early 1800's Elias Hasket Derby of Salem / Boston was a true 1% -- in London his credit was considered to be equal to that of the US Treasury and he had as relatives the Cabots, Crowinshields and Peabodys who were almost as wealthy

in 1869 when he died George Peabody (founder / benefactor of the PEM) was worth $16 million (approximately 1/556th of US GNP)

at the end of the 19th Century Andrew Carnegie sold his steel company to a consortium headed by J.P. Morgan for a check for $1B

Isabella Stewart aka Mrs. Jack Gardner's house/museum - aka the Palace cost over $3 M not counting the art

from the wiki:

John Lowell Gardner II aka Jack -- mother, Catherine Endicott Peabody was the daughter of shipowner, Joseph Peabody (1757–1844), who made a fortune importing pepper from Sumatra and was one of the wealthiest men in the United States at the time of his death in 1844.

Jack's paternal grandfather, Samuel Pickering Gardner (1768–1843), descended from Thomas Gardner (planter) and from the father of Timothy Pickering. Through his paternal grandmother, Rebecca Russell Lowell, he descended from Percival Lowell who had arrived at Cape Ann in 1639.

After spending time at Harvard, Jack entered his father's East Indies trading business.

The John L. Gardners' (I and II) ships sailed many seas. The Gardners partnered with Joseph Peabody.

Some of the ships included: Arabia, Bunker Hill, California, Democrat, Duxbury, Eclipse, Gentleman, Grotius, Lenore, Lepanto, Lotos, Marquis de Somerulas, Mars, Monterey, Nabob, Napke, Naples, Pallas, Pioneer, Plant, Plato, Ruble, Sappho, Shawmut, St Paul, Sumatra, Thetis, Unicorn.

Jack had financial interests besides shipping, such as railroads (Chicago, Burlington and Quincy Railroad) and mining (Calumet and Hecla Mining Company). He supported the America's Cup defender, Puritan.

In the early 1900's John D. Rockefeller's personal fortune was more than a couple of percent of the US GDP equivalent to something of the order of $500B today -- no one is remotely close

By the way --- Today 1 in 20 (i.e. 5%) of the families in MA have a net worth in excess of $1M -- in Weston (where was occupy Weston when you need it?) the % of millionaires is 25% and the median house price is over $1M

Fair enough. Perhaps my comment poking fun at that exact issue arising in threads only contributed to it. I prematurely anticipated a comment that may or may not have been coming.

It comes down to this being a major Boston company undergoing a major expansion, which is great for the state of the city's economy.

Data and the rest -- Punt the 1% BS -- there is only a single fraction of 1% that matters -- the brave men and women who put there lives on the line for the rest of us to be able to have this discussion at our leisure

For reference purposes -- there is nothing today like the concentration of wealth in the US the past:

in the early 1800's Elias Hasket Derby of Salem / Boston was a true 1% -- in London his credit was considered to be equal to that of the US Treasury and he had as relatives the Cabots, Crowinshields and Peabodys who were almost as wealthy

in 1869 when he died George Peabody (founder / benefactor of the PEM) was worth $16 million (approximately 1/556th of US GNP)

at the end of the 19th Century Andrew Carnegie sold his steel company to a consortium headed by J.P. Morgan for a check for $1B

Isabella Stewart aka Mrs. Jack Gardner's house/museum - aka the Palace cost over $3 M not counting the art

from the wiki:

John Lowell Gardner II aka Jack -- mother, Catherine Endicott Peabody was the daughter of shipowner, Joseph Peabody (1757–1844), who made a fortune importing pepper from Sumatra and was one of the wealthiest men in the United States at the time of his death in 1844.

Jack's paternal grandfather, Samuel Pickering Gardner (1768–1843), descended from Thomas Gardner (planter) and from the father of Timothy Pickering. Through his paternal grandmother, Rebecca Russell Lowell, he descended from Percival Lowell who had arrived at Cape Ann in 1639.

After spending time at Harvard, Jack entered his father's East Indies trading business.

The John L. Gardners' (I and II) ships sailed many seas. The Gardners partnered with Joseph Peabody.

Some of the ships included: Arabia, Bunker Hill, California, Democrat, Duxbury, Eclipse, Gentleman, Grotius, Lenore, Lepanto, Lotos, Marquis de Somerulas, Mars, Monterey, Nabob, Napke, Naples, Pallas, Pioneer, Plant, Plato, Ruble, Sappho, Shawmut, St Paul, Sumatra, Thetis, Unicorn.

Jack had financial interests besides shipping, such as railroads (Chicago, Burlington and Quincy Railroad) and mining (Calumet and Hecla Mining Company). He supported the America's Cup defender, Puritan.

In the early 1900's John D. Rockefeller's personal fortune was more than a couple of percent of the US GDP equivalent to something of the order of $500B today -- no one is remotely close

By the way --- Today 1 in 20 (i.e. 5%) of the families in MA have a net worth in excess of $1M -- in Weston (where was occupy Weston when you need it?) the % of millionaires is 25% and the median house price is over $1M

whighlander

Senior Member

- Joined

- Aug 14, 2006

- Messages

- 7,812

- Reaction score

- 647

Re: Liberty Mutual plans major Boston expansion

Stat -- sorry -- I suffer from both acute and chronic incipient professorialism -- aka the propensity and ability to drone on about nearly any topic for at least 6 paragraphs -- my wife thinks that any discussion which she initiates rapidly devolves into a graduate lecture presented by me -- often to the dog -- the only listener who remains

Westie, did you really just say to drop the political talk and then drone on for about 6 paragraphs about that exact same topic?

Stat -- sorry -- I suffer from both acute and chronic incipient professorialism -- aka the propensity and ability to drone on about nearly any topic for at least 6 paragraphs -- my wife thinks that any discussion which she initiates rapidly devolves into a graduate lecture presented by me -- often to the dog -- the only listener who remains

Pierce

Active Member

- Joined

- May 29, 2008

- Messages

- 461

- Reaction score

- 1

Re: Liberty Mutual plans major Boston expansion

When you compare the hundreds of billions of Derby, Carnegie and Rockefeller to the tens of billions of Gates, Buffett, or the Waltons you are not talking about the top 1% so much as the top 0.00000001% (put another way, the 1% of the 1% of the 1% of the 1%).

We have antitrust laws to thank for that balancing, but there are alot of zeros between your argument and wealth distribution between population 99:1.

The Paris School of Economics has a great website to study this stuff by country. Their numbers only go back as far as 1913 (Not the gilded age, but not bad--Standard Oil was broken up in 1911) but the pattern does not quite jive with your historical analysis:

.svg)

For reference purposes -- there is nothing today like the concentration of wealth in the US the past:

When you compare the hundreds of billions of Derby, Carnegie and Rockefeller to the tens of billions of Gates, Buffett, or the Waltons you are not talking about the top 1% so much as the top 0.00000001% (put another way, the 1% of the 1% of the 1% of the 1%).

We have antitrust laws to thank for that balancing, but there are alot of zeros between your argument and wealth distribution between population 99:1.

The Paris School of Economics has a great website to study this stuff by country. Their numbers only go back as far as 1913 (Not the gilded age, but not bad--Standard Oil was broken up in 1911) but the pattern does not quite jive with your historical analysis:

- Joined

- Sep 15, 2010

- Messages

- 8,894

- Reaction score

- 271

Re: Liberty Mutual plans major Boston expansion

Aye caramba. I'm so sorry guys. This was not my intent.

Aye caramba. I'm so sorry guys. This was not my intent.