Donald Trump's leaked tax returns help explain why he wants to end the estate tax

Josh Barro

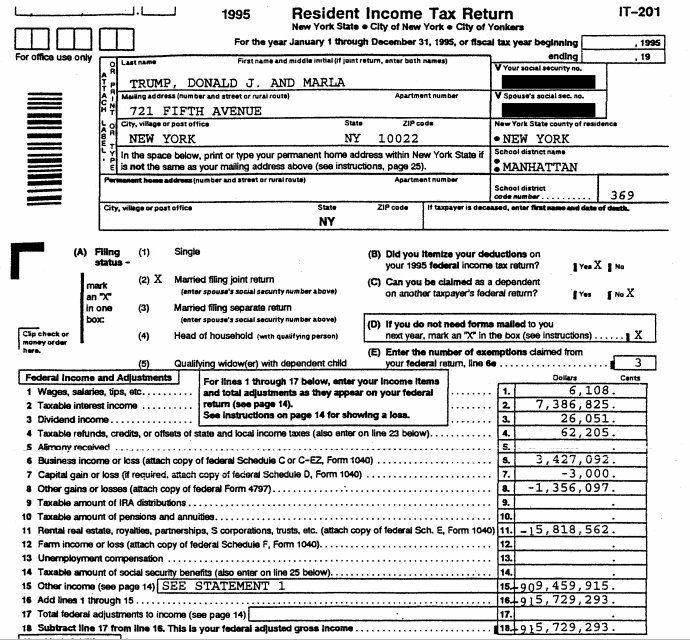

The $916 million loss that Donald Trump reported on his 1995 income taxes was extraordinary. As Alan Cole from the conservative Tax Foundation notes, total net operating losses claimed on all individual income tax returns in 1995 amounted to $49.3 billion.*

That is, in that year, Trump claimed nearly 2% of all the net negative business income on individual tax returns in the entire country.

Broadly, Trump's reported loss has to fall into two buckets, neither of which is great for Trump's argument that he ought to be president.

1.) Trump likely had significant real economic losses. The early 1990s were a rough period for real estate investors in general. Plus, Trump somehow found a way to lose money operating Atlantic City casinos at a time when East Coast gambling licenses were highly restricted in number and generally extremely profitable to hold. Trump became insolvent in the early 1990s as his casinos and some other real-estate assets declined in value and he nearly went bankrupt. If you have negative income (as Trump surely did in some years in the early 1990s) you don't get to have a negative tax bill; instead, you carry the losses forward onto future years' tax returns, as he did onto his 1995 taxes.

2.) Trump also, like many real-estate developers, likely benefited from significant paper losses he could take on his tax return that did not reflect real economic losses. This does not mean he was illegally evading taxes. For example, the tax code has a variety of provisions for depreciating buildings as they age — as your building gets older and less nice, you can deduct a decline in value as a business expense. This depreciation expense is based on a fixed schedule, and you can take it on your taxes even if your building is, in fact, rising in value. This is all supposed to come out in the wash in the end, because when you sell the building, you pay tax on the difference between your sale price and your purchase price, with all those depreciation expenses you took over the years deducted from the purchase price. But you can delay that tax bill as long as you delay selling the property, which can be a very long time.

So, why did Trump have such a yugely negative reported income? The story is almost surely a little from the first option ("I'm not very good at the real estate business and am mostly rich because I inherited lots of money") and a little from the second ("I had real income but I found ways to avoid paying tax on it even though you little people had to pay tax on your income.")

One fact that points toward the second explanation is that Trump's 1995 taxes reflect not just a large carried-forward loss from prior years, but also a $16 million loss from real estate and other partnerships related to 1995 itself. Real-estate investments were on the upswing again in 1995, so if Trump was really still losing money, that's a pretty bad sign about his business acumen.

Indeed, Trump's campaign seems to be settling on explanation No. 2, judging by the choice of surrogates like former New York City Mayor Rudy Giuliani and New Jersey Gov. Chris Christie to go on national television and praise Trump as a "genius" for reporting a negative income and paying no taxes. Trump also chose to say "that makes me smart" when Hillary Clinton accused him of avoiding taxes on his income at last week's debate.

There are some other questions, like whether Trump used creative methods to take credit on his own taxes for losses that were actually borne by banks and other creditors he stiffed. We can't answer those questions without more detailed records than the three pages of tax-return information that were leaked to The New York Times.

But there is one important upshot from the "he's a genius" explanation that hasn't been remarked on much. That Trump has accrued so many reported losses on his taxes helps explain why he's so eager to repeal the estate tax.

As I noted above, the "genius" of using strategies like depreciation expenses on real estate isn't that they avoid tax forever. It's that they allow a long delay in taxes on income related to real estate. Under current law, those taxes end up getting delayed until a real-estate asset is sold (and sometimes longer; a strategy called a 1031 exchange allows you to continue the delay so long as you buy a similar asset with the proceeds of the sale) or until you die.

At your death, the appreciation on real-estate assets doesn't get taxed. But if you're worth more than $10 million, like Trump presumably is, most of the value of your bequeathed assets can be subjected to estate tax at rates up to 40%. That can be a bigger bite than the income tax that got avoided all along.

But if Trump gets elected and gets his way on estate-tax repeal, he'll be able to pass his assets to his children tax-free when he dies — and his children (and their children and their children) will be able to avoid tax on accrued gains in the value of their real-estate portfolio as long as they don't ever sell it.

That is, Trump seems to have cleverly used the tax code to delay a lot of taxes. But if he becomes president, he can find a way for him and his family to avoid ever having to pay tax on a bunch of the income he's earned over the decades.

In a way, that would be pretty smart. It's a lot smarter than the way he managed his casinos.

*Trump's loss appears to have been mostly carried forward from prior years. This comparison is apples-to-apples because the $49.3 billion IRS figure for all individual tax returns also includes losses carried forward from prior years by other taxpayers.

This is an editorial. The opinions and conclusions expressed above are those of the author.

http://www.businessinsider.com/trump-tax-returns-estate-taxes-hillary-clinton-2016-10